Optimize and backtest mean-variance & CVaR portfolios with real-world examples in R.

In Part2 we dive into mean variance portfolio optimization, mean CVar portfolios and backtesting. As mentioned in part1 we conclude this tutorial with a full blown portfolio optimization process with a real world example. After going through all of the content you should have acquired profound knowledge of portfolio optimization in R and be able to optimize any kind of portfolio with your eyes closed.

Content

PART1:

- Working with data

- Loading times series data sets

- Reading data from CSV files

- Downloading data from the internet

- Modifying time series data

- Sample time series data randomly

- Sorting in ascending order

- Reverse data

- Alignment of timeSeries objects

- Merging time series data

- Binding time series

- Merging columns and rows

- Subsetting data and replacing parts of a data set

- Find first and last records in a time series

- Subset by column names

- Extract specific date

- Aggregating data

- Computing rolling statistics

- Manipulate data with financial functions

- Robust statistical methods

- Robust covariance estimators

- Comparing robust covariances

- Implementing the portfolio framework

- Specify a portfolio of assets

- Choosing an objective when optimizing a portfolio

- Estimating mean and covariance of asset returns

- Working with tail risk

- Set and modify portfolio parameters

PART2:

- Representing data with timeSeries objects

- Set portfolio constraints

- Constructing portfolio constraints

- Set lower and upper bounds

- Optimizing a portfolio

- Mean variance portfolio

- Minimum risk efficient portfolio

- Global minimum variance portfolio

- Case study portfolio optimization

- Mean-CVaR portfolio optimization

- Unlimited short portfolio

- Long only portfolio

- Box constrained portfolio

- Group constrained portfolio

- Portfolio backtesting

- Backtesting sector rotation portfolio

- Plot backtest

- What to do next

Representing data with timeSeries objects

With S4 timeSeries objects found in the rmetrics package we can represent data for portfolio optimization. To create an S4 object of class fPFOLIODATA we use the function portfolioData().

1>showClass("fPFOLIODATA")

2Class "fPFOLIODATA" [package "fPortfolio"]

3

4Slots:

5

6Name: data statistics tailRisk

7Class: list list list

The function portfolioData() allows us to define data settings that we can use in portfolio functions. To illustrate this with an example we use the LPP2005.RET data set working with columns “SBI”,”SPI”,”LMI” and “MPI”. We create a portfolio object with the data set and the default portfolio specification.

1>args(portfolioData)

2function (data, spec = portfolioSpec())

3NULL

4>lppAssets <- 100 * LPP2005.RET[, c("SBI", "SPI", "LMI", "MPI")]

5>lppData <- portfolioData(data = lppAssets, spec = portfolioSpec())

With the function str() we take a look inside the data structure of a portfolio.

1>str(lppData, width = 65, strict.width = "cut")

2Formal class 'fPFOLIODATA' [package "fPortfolio"] with 3 slots

3 ..@ data :List of 3

4 .. ..$ series :Time Series:

5 Name: object

6Data Matrix:

7 Dimension: 377 4

8 Column Names: SBI SPI LMI MPI

9 Row Names: 2005-11-01 ... 2007-04-11

10Positions:

11 Start: 2005-11-01

12 End: 2007-04-11

13With:

14 Format: %Y-%m-%d

15 FinCenter: GMT

16 Units: SBI SPI LMI MPI

17 Title: Time Series Object

18 Documentation: Tue Jan 20 17:49:06 2009 by user:

19 .. ..$ nAssets: int 4

20 .. ..$ names : chr [1:4] "SBI" "SPI" "LMI" "MPI"

21 ..@ statistics:List of 5

22 .. ..$ mean : Named num [1:4] 4.07e-05 8.42e-02 5.53e-03 ..

23 .. .. ..- attr(*, "names")= chr [1:4] "SBI" "SPI" "LMI" "MPI"

24 .. ..$ Cov : num [1:4, 1:4] 0.0159 -0.0127 0.0098 -0.015..

25 .. .. ..- attr(*, "dimnames")=List of 2

26 .. .. .. ..$ : chr [1:4] "SBI" "SPI" "LMI" "MPI"

27 .. .. .. ..$ : chr [1:4] "SBI" "SPI" "LMI" "MPI"

28 .. ..$ estimator: chr "covEstimator"

29 .. ..$ mu : Named num [1:4] 4.07e-05 8.42e-02 5.53e-03 ..

30 .. .. ..- attr(*, "names")= chr [1:4] "SBI" "SPI" "LMI" "MPI"

31 .. ..$ Sigma : num [1:4, 1:4] 0.0159 -0.0127 0.0098 -0.015..

32 .. .. ..- attr(*, "dimnames")=List of 2

33 .. .. .. ..$ : chr [1:4] "SBI" "SPI" "LMI" "MPI"

34 .. .. .. ..$ : chr [1:4] "SBI" "SPI" "LMI" "MPI"

35 ..@ tailRisk : list()

With the command print(lppData) we can print a portfolio data object. The output prints the first and last three lines of the data set alongside the sample mean and covariance estimates found in the @statistics slot.

1>print(lppData)

2

3Head/Tail Series Data:

4

5GMT

6 SBI SPI LMI MPI

72005-11-01 -0.0612745 0.8414595 -0.1108882 0.1548062

82005-11-02 -0.2762009 0.2519342 -0.1175939 0.0342876

92005-11-03 -0.1153092 1.2707292 -0.0992456 1.0502959

10GMT

11 SBI SPI LMI MPI

122007-04-09 0.0000000 0.0000000 -0.1032441 0.8179152

132007-04-10 -0.0688995 0.6329425 -0.0031500 -0.1428291

142007-04-11 0.0306279 -0.1044170 -0.0090900 -0.0991064

15

16Statistics:

17

18$mean

19 SBI SPI LMI MPI

200.0000406634 0.0841754390 0.0055315332 0.0590515119

21

22$Cov

23 SBI SPI LMI MPI

24SBI 0.015899554 -0.01274142 0.009803865 -0.01588837

25SPI -0.012741418 0.58461212 -0.014074691 0.41159843

26LMI 0.009803865 -0.01407469 0.014951108 -0.02332223

27MPI -0.015888368 0.41159843 -0.023322233 0.53503263

28

29$estimator

30[1] "covEstimator"

31

32$mu

33 SBI SPI LMI MPI

340.0000406634 0.0841754390 0.0055315332 0.0590515119

35

36$Sigma

37 SBI SPI LMI MPI

38SBI 0.015899554 -0.01274142 0.009803865 -0.01588837

39SPI -0.012741418 0.58461212 -0.014074691 0.41159843

40LMI 0.009803865 -0.01407469 0.014951108 -0.02332223

41MPI -0.015888368 0.41159843 -0.023322233 0.53503263

The S4 time series object is kept in the @data slot. We can extract the content with the function getData().

1>Data <- portfolioData(lppData)

2>getData(Data)[-1]

3$nAssets

4[1] 4

5

6$names

7[1] "SBI" "SPI" "LMI" "MPI"

The content of the @statistics slot holds information on the mean and covariance matrix and can be called with the getStatistics() function.

1>getStatistics(Data)

2$mean

3 SBI SPI LMI MPI

40.0000406634 0.0841754390 0.0055315332 0.0590515119

5

6$Cov

7 SBI SPI LMI MPI

8SBI 0.015899554 -0.01274142 0.009803865 -0.01588837

9SPI -0.012741418 0.58461212 -0.014074691 0.41159843

10LMI 0.009803865 -0.01407469 0.014951108 -0.02332223

11MPI -0.015888368 0.41159843 -0.023322233 0.53503263

12

13$estimator

14[1] "covEstimator"

15

16$mu

17 SBI SPI LMI MPI

180.0000406634 0.0841754390 0.0055315332 0.0590515119

19

20$Sigma

21 SBI SPI LMI MPI

22SBI 0.015899554 -0.01274142 0.009803865 -0.01588837

23SPI -0.012741418 0.58461212 -0.014074691 0.41159843

24LMI 0.009803865 -0.01407469 0.014951108 -0.02332223

25MPI -0.015888368 0.41159843 -0.023322233 0.53503263

Set portfolio constraints

By using constraints we are defining restrictions on portfolio weights. In the r metrics package the function portfolioConstraints() creates the default settings and reports on all constraints.

1>showClass("fPFOLIOCON")

2Class "fPFOLIOCON" [package "fPortfolio"]

3

4Slots:

5

6Name: stringConstraints minWConstraints maxWConstraints eqsumWConstraints

7Class: character numeric numeric matrix

8

9Name: minsumWConstraints maxsumWConstraints minBConstraints maxBConstraints

10Class: matrix matrix numeric numeric

11

12Name: listFConstraints minFConstraints maxFConstraints minBuyinConstraints

13Class: list numeric numeric numeric

14

15Name: maxBuyinConstraints nCardConstraints minCardConstraints maxCardConstraints

16Class: numeric integer numeric numeric

The function portfolioConstraints() consists of the following arguments:

Argument: constraints

Values:

- “LongOnly” long-only constraints [0,1]

- “Short” unlimited short selling, [-Inf,Inf]

- “minW[<…>]=<…> lower box bounds

- “maxw[<…>]=<…> upper box bounds

- “minsumW[<…>]=<…> lower group bounds

- “maxsumW[<…>]=<…> upper group bounds

- “minB[<…>]=<…> lower covariance risk budget bounds

- “maxB[<…>]=<…> upper covariance risk budget bounds

- “listF=list(<…>)” list of non-linear functions

- “minf[<…>]=<…>” lower non-linear function bounds

- “maxf[<…>]=<…>” upper covariance risk budget

Constructing portfolio constraints

The example below creates Long-only settings for returns from the LPP2005 data set ,displays the structure of a portfolio constrains object and prints the results.

1>Data <- 100 * LPP2005.RET[, 1:3]

2>Spec <- portfolioSpec()

3>setTargetReturn(Spec) <- mean(Data)

4>Constraints <- "LongOnly"

5>defaultConstraints <- portfolioConstraints(Data, Spec, Constraints)

6>str(defaultConstraints, width = 65, strict.width = "cut")

7Formal class 'fPFOLIOCON' [package "fPortfolio"] with 16 slots

8 ..@ stringConstraints : chr "LongOnly"

9 ..@ minWConstraints : Named num [1:3] 0 0 0

10 .. ..- attr(*, "names")= chr [1:3] "SBI" "SPI" "SII"

11 ..@ maxWConstraints : Named num [1:3] 1 1 1

12 .. ..- attr(*, "names")= chr [1:3] "SBI" "SPI" "SII"

13 ..@ eqsumWConstraints : num [1:2, 1:4] 3.60e-02 -1.00 4.07e-..

14 .. ..- attr(*, "dimnames")=List of 2

15 .. .. ..$ : chr [1:2] "Return" "Budget"

16 .. .. ..$ : chr [1:4] "ceq" "SBI" "SPI" "SII"

17 ..@ minsumWConstraints : logi [1, 1] NA

18 ..@ maxsumWConstraints : logi [1, 1] NA

19 ..@ minBConstraints : Named num [1:3] -Inf -Inf -Inf

20 .. ..- attr(*, "names")= chr [1:3] "SBI" "SPI" "SII"

21 ..@ maxBConstraints : Named num [1:3] 1 1 1

22 .. ..- attr(*, "names")= chr [1:3] "SBI" "SPI" "SII"

23 ..@ listFConstraints : list()

24 ..@ minFConstraints : num(0)

25 ..@ maxFConstraints : num(0)

26 ..@ minBuyinConstraints: Named num [1:3] 0 0 0

27 .. ..- attr(*, "names")= chr [1:3] "SBI" "SPI" "SII"

28 ..@ maxBuyinConstraints: Named num [1:3] 1 1 1

29 .. ..- attr(*, "names")= chr [1:3] "SBI" "SPI" "SII"

30 ..@ nCardConstraints : int 3

31 ..@ minCardConstraints : Named num [1:3] 0 0 0

32 .. ..- attr(*, "names")= chr [1:3] "SBI" "SPI" "SII"

33 ..@ maxCardConstraints : Named num [1:3] 1 1 1

34 .. ..- attr(*, "names")= chr [1:3] "SBI" "SPI" "SII"

35>print(defaultConstraints)

36

37Title:

38 Portfolio Constraints

39

40Lower/Upper Bounds:

41 SBI SPI SII

42Lower 0 0 0

43Upper 1 1 1

44

45Equal Matrix Constraints:

46 ceq SBI SPI SII

47Return 0.03603655 4.06634e-05 0.08417544 0.02389356

48Budget -1.00000000 -1.00000e+00 -1.00000000 -1.00000000

49

50Cardinality Constraints:

51 SBI SPI SII

52Lower 0 0 0

53Upper 1 1 1

To consider another example we can use short selling constraints instead of a long-only portfolio.

1>shortConstraints <- "Short"

2>portfolioConstraints(Data, Spec, shortConstraints)

3

4Title:

5 Portfolio Constraints

6

7Lower/Upper Bounds:

8 SBI SPI SII

9Lower -Inf -Inf -Inf

10Upper Inf Inf Inf

11

12Equal Matrix Constraints:

13 ceq SBI SPI SII

14Return 0.03603655 4.06634e-05 0.08417544 0.02389356

15Budget -1.00000000 -1.00000e+00 -1.00000000 -1.00000000

16

17Cardinality Constraints:

18 SBI SPI SII

19Lower 0 0 0

20Upper 1 1 1

Using box constraints and setting the lower bounds to negative values we can implement arbitrary short selling. With the two character strings minW and maxW we can limit the portfolio weights by lower and upper bounds.

1>box.1 <- "minW[1:3] = 0.1"

2>box.2 <- "maxW[c(1,3)] = c(0.5, 0.6)"

3>box.3 <- "maxW[2] = 0.4"

4>boxConstraints <- c(box.1, box.2, box.3)

5>boxConstraints

6[1] "minW[1:3] = 0.1" "maxW[c(1,3)] = c(0.5, 0.6)" "maxW[2] = 0.4"

7> portfolioConstraints(Data, Spec, boxConstraints)

8

9Title:

10 Portfolio Constraints

11

12Lower/Upper Bounds:

13 SBI SPI SII

14Lower 0.1 0.1 0.1

15Upper 0.5 0.4 0.6

16

17Equal Matrix Constraints:

18 ceq SBI SPI SII

19Return 0.03603655 4.06634e-05 0.08417544 0.02389356

20Budget -1.00000000 -1.00000e+00 -1.00000000 -1.00000000

21

22Cardinality Constraints:

23 SBI SPI SII

24Lower 0 0 0

25Upper 1 1 1

The constraints above tell us that we want to invest a minimum of 10% in each asset (see lower bound 0.1, 0.1, 0.1) and not more than 50% in the first asset. A 40% maximum investment for the second asset and 60% maximum investment in the third asset. Another method that we can use is to define the total weight of a group of assets. We can use the following strings to set group constraints:

Constraints Settings:

- “eqsumW” equality group constraints #total amount invested in a group of assets

- “minsumW” lower bounds group constraints

- “maxsumw” upper bounds group constraints

1>group.1 <- "eqsumW[c(1,3)]=0.6"

2>group.2 <- "minsumW[c(2,3)]=0.2"

3>group.3 <- "maxsumW[c(1,2)]=0.7"

4>groupConstraints <- c(group.1, group.2, group.3)

5>groupConstraints

6[1] "eqsumW[c(1,3)]=0.6" "minsumW[c(2,3)]=0.2" "maxsumW[c(1,2)]=0.7"

7>portfolioConstraints(Data, Spec, groupConstraints)

8

9Title:

10 Portfolio Constraints

11

12Lower/Upper Bounds:

13 SBI SPI SII

14Lower 0 0 0

15Upper 1 1 1

16

17Equal Matrix Constraints:

18 ceq SBI SPI SII

19Return 0.03603655 4.06634e-05 0.08417544 0.02389356

20Budget -1.00000000 -1.00000e+00 -1.00000000 -1.00000000

21eqsumW 0.60000000 1.00000e+00 0.00000000 1.00000000

22

23Lower Matrix Constraints:

24 avec SBI SPI SII

25lower 0.2 0 1 1

26

27Upper Matrix Constraints:

28 avec SBI SPI SII

29upper 0.7 1 1 0

30

31Cardinality Constraints:

32 SBI SPI SII

33Lower 0 0 0

34Upper 1 1 1

The first string means that we invest 60% in asset 1 and 3. For group.2 we invest a minimum of 20% in asset 2 and 3. For group.3 we invest a maximum of 70% in asset 1 and 2.

Set lower and upper bounds

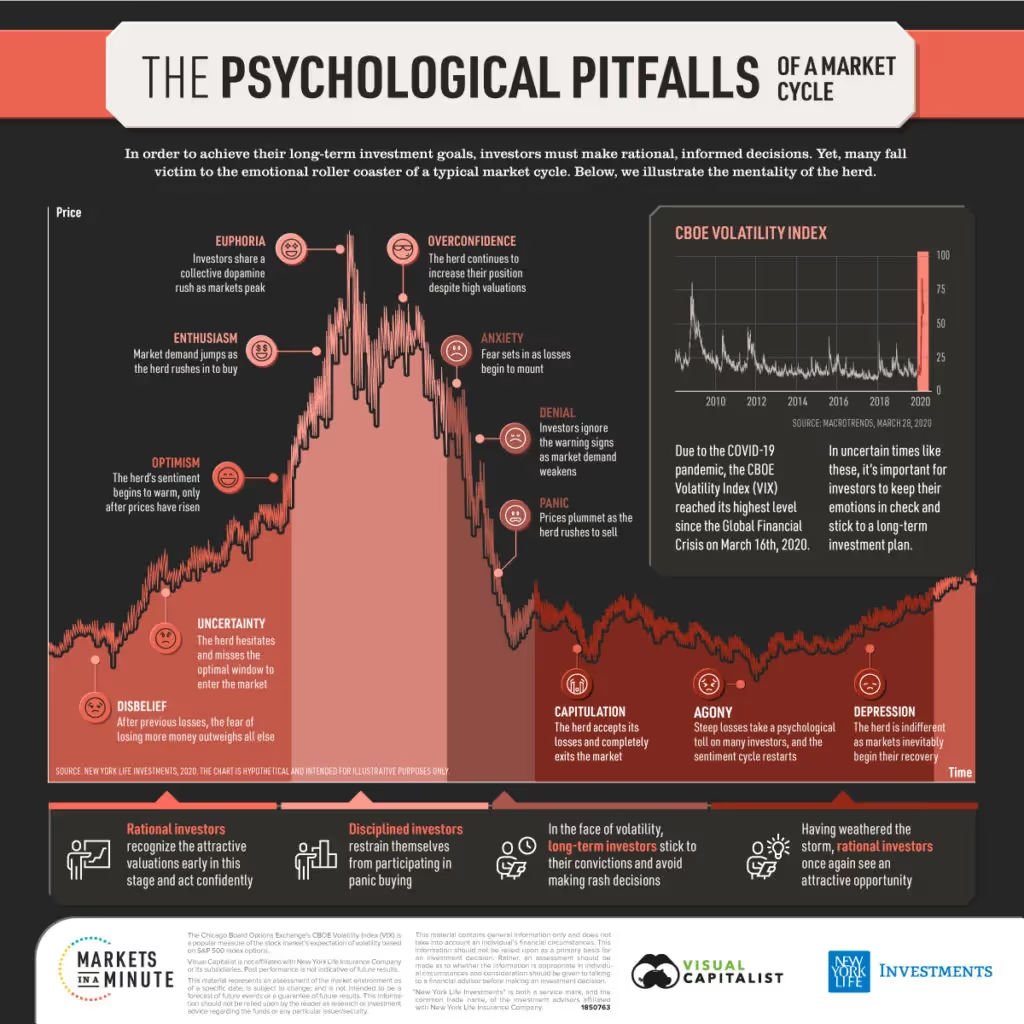

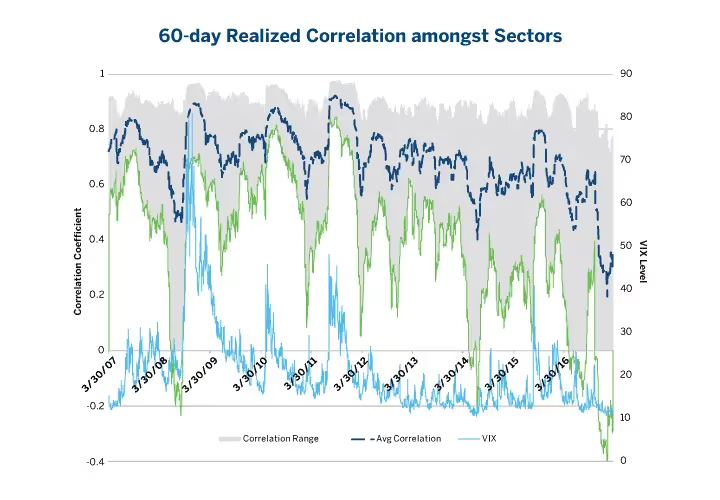

Probably the question running through your mind is, “Sounds interesting but how can I know how to set lower and upper bounds?” This is up to you to decide. However, more often than not the simplest solutions work best. For example, if you are about to set the weights for a sector the best way forward would be to construct spread indices of the sectors you want to invest your money in. Mr. Market already showed us numerous times that when volatility in the market crests, the performance of all stocks tends to be highly correlated. Stocks in different sectors start to wander when volatility goes down and things magically become less correlated. The graph below illustrates this phenomenon. Take a close look.

The blue dotted line shows the average correlation for all pairs of sectors based on the S&P Select Sector Indexes. The shaded area shows the correlation amongst different sectors. As we can see sectors tend to decouple when volatility subsides. In order to measure if a sector is “overbought” or “oversold” we can construct a spread between two sectors. Of course there is not a “best way” to construct these sector spreads so they should only be used as a guideline for defining meaningful portfolio weights. By way of example, if a portfolio manager has a view that the technology sector will underperform the market while the energy sector will outperform the market, one can conceivably buy $1 million of the energy sector exposure while short selling $1 million of the technology sector. By using the following equation we can find more relevant coefficients:

We estimate β by regressing the historical returns of the sector on those of the overall market. We can set the exposure in Sector A to one dollar and µ dollar of exposure is sold in Sector B. The total sensitivity to the market returns is defined as (βA–μβB). We eliminate exposure to the overall market by setting µ:

In this example µ is greater than 1 if B is less sensitive than sector A to the overall market return. Translated into trader language it means that we have to adjust our B sector position upward. This is your guideline. The fine tuning happens during the portfolio optimization process. If you want to elaborate on this further we advise you to read the article on the CME website.

Optimizing a portfolio

With the following portfolio optimization functions we compute or optimize a single portfolio. These functions are part of the fPortfolio package.

Portfolio Functions:

- feasiblePortfolio: returns a feasible portfolio given the

- vector of portfolio weights

- efficientPortfolio: returns the portfolio with the lowest risk for a given target return

- maxratioPortfolio: returns the portfolio with the highest return/risk ratio

- tangencyPortfolio :synonym for maxratioPortfolio

- minriskPortfolio: returns a portfolio with the lowest risk at all

- minvariancePortfolio: synonym for minriskPortfolio

- maxreturnPortfolio: returns the portfolio with the highest return for a given target risk

- portfolioFrontier: computes portfolios on the efficient frontier and/or on the minimum covariance locus.

To display the structure of our portfolio object we type:

1>library(fPortfolio)

2>showClass("fPORTFOLIO")

3Class "fPORTFOLIO" [package "fPortfolio"]

4

5Slots:

6

7Name: call data spec constraints portfolio title description

8Class: call fPFOLIODATA fPFOLIOSPEC fPFOLIOCON fPFOLIOVAL character character

9>args(feasiblePortfolio)

10function (data, spec = portfolioSpec(), constraints = "LongOnly")

11NULL

12>tgPortfolio <- tangencyPortfolio(100 * LPP2005.RET[, 1:6])

13>str(tgPortfolio, width = 65, strict.width = "cut")

14Formal class 'fPORTFOLIO' [package "fPortfolio"] with 7 slots

15 ..@ call : language maxratioPortfolio(data = data, spec..

16 ..@ data :Formal class 'fPFOLIODATA' [package "fPortfo"..

17 .. .. ..@ data :List of 3

18 .. .. .. ..$ series :Time Series:

19 Name: object

20Data Matrix:

21 Dimension: 377 6

22 Column Names: SBI SPI SII LMI MPI ALT

23 Row Names: 2005-11-01 ... 2007-04-11

24Positions:

25 Start: 2005-11-01

26 End: 2007-04-11

27With:

28 Format: %Y-%m-%d

29 FinCenter: GMT

30 Units: SBI SPI SII LMI MPI ALT

31 Title: Time Series Object

32 Documentation: Tue Jan 20 17:49:06 2009 by user:

33 .. .. .. ..$ nAssets: int 6

34 .. .. .. ..$ names : chr [1:6] "SBI" "SPI" "SII" "LMI" ...

35 .. .. ..@ statistics:List of 5

36 .. .. .. ..$ mean : Named num [1:6] 4.07e-05 8.42e-02 2.3..

37 .. .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII"..

38 .. .. .. ..$ Cov : num [1:6, 1:6] 0.0159 -0.0127 0.0018 ..

39 .. .. .. .. ..- attr(*, "dimnames")=List of 2

40 .. .. .. .. .. ..$ : chr [1:6] "SBI" "SPI" "SII" "LMI" ...

41 .. .. .. .. .. ..$ : chr [1:6] "SBI" "SPI" "SII" "LMI" ...

42 .. .. .. ..$ estimator: chr "covEstimator"

43 .. .. .. ..$ mu : Named num [1:6] 4.07e-05 8.42e-02 2.3..

44 .. .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII"..

45 .. .. .. ..$ Sigma : num [1:6, 1:6] 0.0159 -0.0127 0.0018 ..

46 .. .. .. .. ..- attr(*, "dimnames")=List of 2

47 .. .. .. .. .. ..$ : chr [1:6] "SBI" "SPI" "SII" "LMI" ...

48 .. .. .. .. .. ..$ : chr [1:6] "SBI" "SPI" "SII" "LMI" ...

49 .. .. ..@ tailRisk : list()

50 ..@ spec :Formal class 'fPFOLIOSPEC' [package "fPortfo"..

51 .. .. ..@ model :List of 5

52 .. .. .. ..$ type : chr "MV"

53 .. .. .. ..$ optimize : chr "minRisk"

54 .. .. .. ..$ estimator: chr "covEstimator"

55 .. .. .. ..$ tailRisk : list()

56 .. .. .. ..$ params :List of 1

57 .. .. .. .. ..$ alpha: num 0.05

58 .. .. ..@ portfolio:List of 6

59 .. .. .. ..$ weights : num [1:6] 0 0.000476 0.182395 0..

60 .. .. .. .. ..- attr(*, "invest")= num 1

61 .. .. .. ..$ targetReturn : logi NA

62 .. .. .. ..$ targetRisk : logi NA

63 .. .. .. ..$ riskFreeRate : num 0

64 .. .. .. ..$ nFrontierPoints: num 50

65 .. .. .. ..$ status : num 0

66 .. .. ..@ optim :List of 5

67 .. .. .. ..$ solver : chr "solveRquadprog"

68 .. .. .. ..$ objective: chr [1:3] "portfolioObjective" "port"..

69 .. .. .. ..$ options :List of 1

70 .. .. .. .. ..$ meq: num 2

71 .. .. .. ..$ control : list()

72 .. .. .. ..$ trace : logi FALSE

73 .. .. ..@ messages :List of 2

74 .. .. .. ..$ messages: logi FALSE

75 .. .. .. ..$ note : chr ""

76 .. .. ..@ ampl :List of 5

77 .. .. .. ..$ ampl : logi FALSE

78 .. .. .. ..$ project : chr "ampl"

79 .. .. .. ..$ solver : chr "ipopt"

80 .. .. .. ..$ protocol: logi FALSE

81 .. .. .. ..$ trace : logi FALSE

82 ..@ constraints:Formal class 'fPFOLIOCON' [package "fPortfol"..

83 .. .. ..@ stringConstraints : chr "LongOnly"

84 .. .. ..@ minWConstraints : Named num [1:6] 0 0 0 0 0 0

85 .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII" ""..

86 .. .. ..@ maxWConstraints : Named num [1:6] 1 1 1 1 1 1

87 .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII" ""..

88 .. .. ..@ eqsumWConstraints : num [1, 1:7] -1 -1 -1 -1 -1 -1..

89 .. .. .. ..- attr(*, "dimnames")=List of 2

90 .. .. .. .. ..$ : chr "Budget"

91 .. .. .. .. ..$ : chr [1:7] "ceq" "SBI" "SPI" "SII" ...

92 .. .. .. ..- attr(*, "na.action")= 'omit' Named num 1

93 .. .. .. .. ..- attr(*, "names")= chr "Return"

94 .. .. ..@ minsumWConstraints : logi [1, 1] NA

95 .. .. ..@ maxsumWConstraints : logi [1, 1] NA

96 .. .. ..@ minBConstraints : Named num [1:6] -Inf -Inf -Inf..

97 .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII" ""..

98 .. .. ..@ maxBConstraints : Named num [1:6] 1 1 1 1 1 1

99 .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII" ""..

100 .. .. ..@ listFConstraints : list()

101 .. .. ..@ minFConstraints : num(0)

102 .. .. ..@ maxFConstraints : num(0)

103 .. .. ..@ minBuyinConstraints: Named num [1:6] 0 0 0 0 0 0

104 .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII" ""..

105 .. .. ..@ maxBuyinConstraints: Named num [1:6] 1 1 1 1 1 1

106 .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII" ""..

107 .. .. ..@ nCardConstraints : int 6

108 .. .. ..@ minCardConstraints : Named num [1:6] 0 0 0 0 0 0

109 .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII" ""..

110 .. .. ..@ maxCardConstraints : Named num [1:6] 1 1 1 1 1 1

111 .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII" ""..

112 ..@ portfolio :Formal class 'fPFOLIOVAL' [package "fPortfol"..

113 .. .. ..@ portfolio:List of 6

114 .. .. .. ..$ weights : Named num [1:6] 0 0.000476 0.182..

115 .. .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII"..

116 .. .. .. ..$ covRiskBudgets: Named num [1:6] 0 0.00141 0.1538..

117 .. .. .. .. ..- attr(*, "names")= chr [1:6] "SBI" "SPI" "SII"..

118 .. .. .. ..$ targetReturn : Named num [1:2] 0.0283 0.0283

119 .. .. .. .. ..- attr(*, "names")= chr [1:2] "mean" "mu"

120 .. .. .. ..$ targetRisk : Named num [1:4] 0.153 0.153 0.31..

121 .. .. .. .. ..- attr(*, "names")= chr [1:4] "Cov" "Sigma" "C"..

122 .. .. .. ..$ targetAlpha : num 0.05

123 .. .. .. ..$ status : num 0

124 .. .. ..@ messages : list()

125 ..@ title : chr "Tangency Portfolio"

126 ..@ description: chr "Tue Jan 26 16:10:30 2021 by user: 1"

127>print(tgPortfolio)

128

129Title:

130 MV Tangency Portfolio

131 Estimator: covEstimator

132 Solver: solveRquadprog

133 Optimize: minRisk

134 Constraints: LongOnly

135

136Portfolio Weights:

137 SBI SPI SII LMI MPI ALT

1380.0000 0.0005 0.1824 0.5753 0.0000 0.2418

139

140Covariance Risk Budgets:

141 SBI SPI SII LMI MPI ALT

1420.0000 0.0014 0.1539 0.1124 0.0000 0.7324

143

144Target Returns and Risks:

145 mean Cov CVaR VaR

1460.0283 0.1533 0.3096 0.2142

Mean-variance portfolio

Defining a mean-variance portfolio includes three steps:

- Step1 – create S4 timeSeries objects with the rmetrics timeSeries package as explained in part1 of our tutorial.

- Step2 – portfolio specification

- Step3 – setting portfolio constraints

For our first example, we start with a minimum risk mean-variance portfolio. The portfolio has a fixed target return and includes feasible, tangency, efficient and global minimum risk portfolios.

To compute a feasible portfolio we can use equal weights. To specify equal weights we use the LPP2005 data set. We type the following:

1>library(fPortfolio)

2>colnames(LPP2005REC)

3[1] "SBI" "SPI" "SII" "LMI" "MPI" "ALT" "LPP25" "LPP40" "LPP60"

4>lppData <- 100 * LPP2005REC[, 1:6]

5

6#the function setWeights() adds the vector of weights to the #specification spec

7>ewSpec <- portfolioSpec()

8>nAssets <- ncol(lppData)

9>setWeights(ewSpec) <- rep(1/nAssets, times = nAssets)

10

11#function feasiblePortfolio() calculates the properties of the portfolio

12>ewPortfolio <- feasiblePortfolio(

13+ data = lppData,

14+ spec = ewSpec,

15+ constraints = "LongOnly")

16>print(ewPortfolio)

17

18Title:

19 MV Feasible Portfolio

20 Estimator: covEstimator

21 Solver: solveRquadprog

22 Optimize: minRisk

23 Constraints: LongOnly

24

25Portfolio Weights:

26 SBI SPI SII LMI MPI ALT

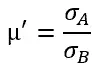

270.1667 0.1667 0.1667 0.1667 0.1667 0.1667

28

29Covariance Risk Budgets:

30 SBI SPI SII LMI MPI ALT

31-0.0039 0.3526 0.0431 -0.0079 0.3523 0.2638

32

33Target Returns and Risks:

34 mean Cov CVaR VaR

350.0431 0.3198 0.7771 0.4472

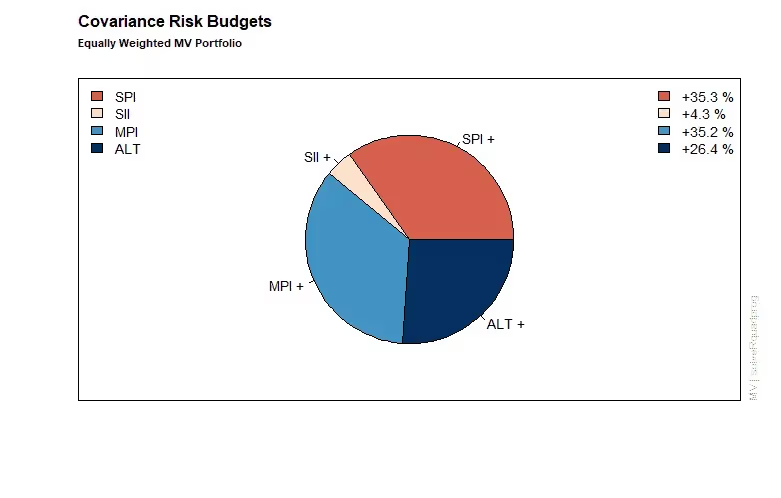

Next, we display the results form the equal weights portfolio including the assignment of weights and the attribution of returns and risk.

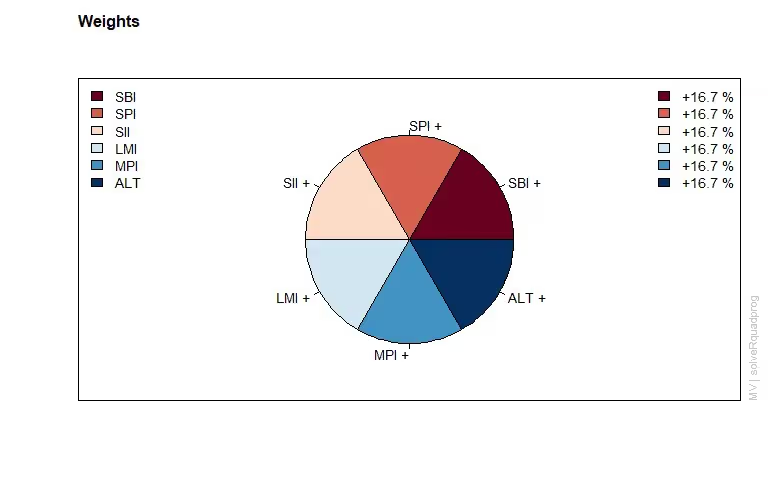

Minimum risk efficient portfolio

We calculate the efficient mean-variance portfolio with the lowest risk for a given return. With the function portfolioSpec() we define a target return and optimize our portfolio.

1>library("fPortfolio")

2>minriskSpec <- portfolioSpec()

3>targetReturn <- getTargetReturn(ewPortfolio@portfolio)["mean"]

4>setTargetReturn(minriskSpec) <- targetReturn

5>minriskPortfolio <- efficientPortfolio(

6+ data = lppData,

7+ spec = minriskSpec,

8+ constraints = "LongOnly")

9> print(minriskPortfolio)

10

11Title:

12 MV Efficient Portfolio

13 Estimator: covEstimator

14 Solver: solveRquadprog

15 Optimize: minRisk

16 Constraints: LongOnly

17

18Portfolio Weights:

19 SBI SPI SII LMI MPI ALT

200.0000 0.0086 0.2543 0.3358 0.0000 0.4013

21

22Covariance Risk Budgets:

23 SBI SPI SII LMI MPI ALT

24 0.0000 0.0184 0.1205 -0.0100 0.0000 0.8711

25

26Target Returns and Risks:

27 mean Cov CVaR VaR

280.0431 0.2451 0.5303 0.3412

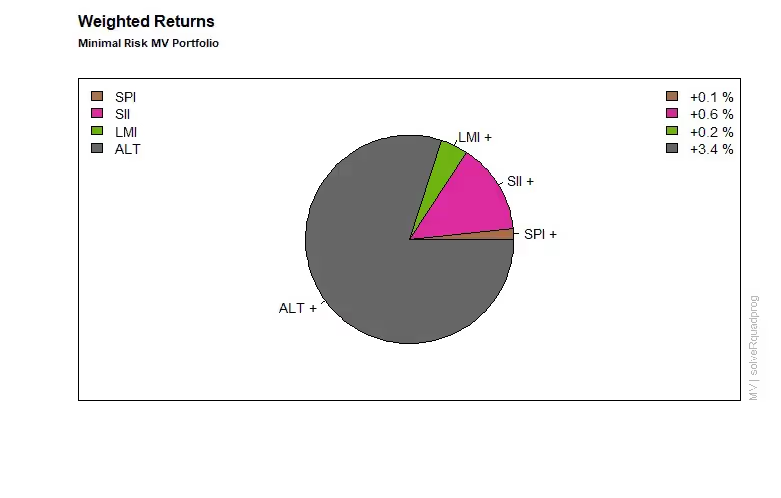

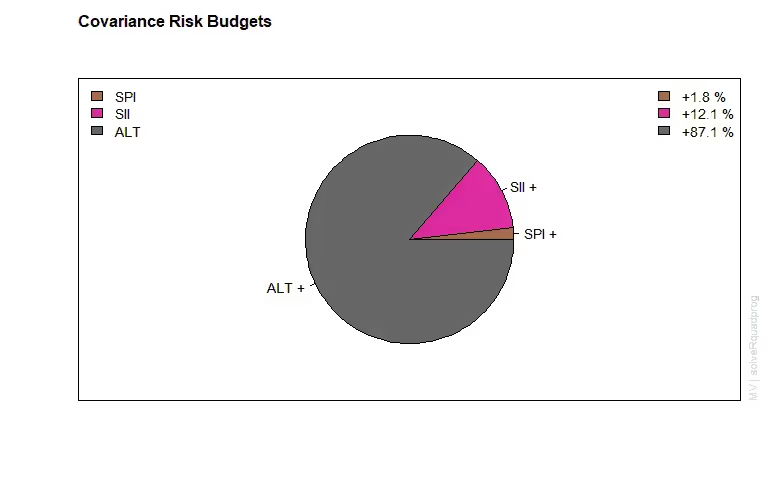

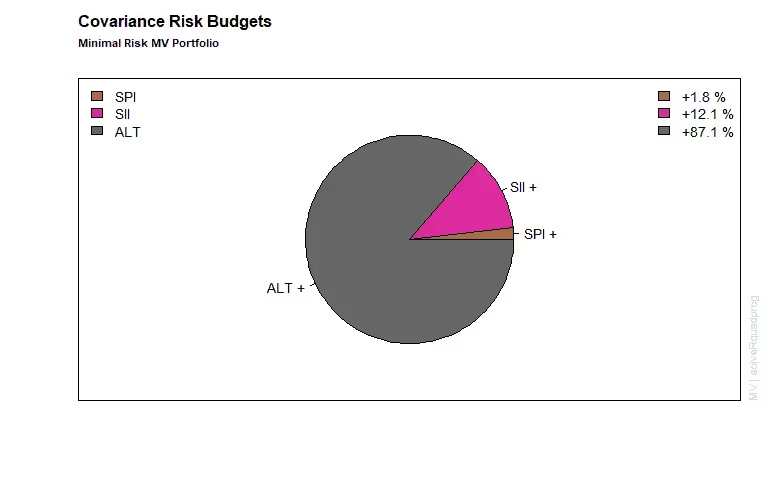

Weights and plots are generated as follows.

1>col <- qualiPalette(ncol(lppData), "Dark2")

2>col <- qualiPalette(ncol(lppData), "Dark2")

3>mtext(text = "Minimal Risk MV Portfolio", side = 3, line = 1.5,

4+ font = 2, cex = 0.7, adj = 0)

5Error in mtext(text = "Minimal Risk MV Portfolio", side = 3, line = 1.5, :

6 plot.new has not been called yet

7>weightedReturnsPie(minriskPortfolio, radius = 0.7, col = col)

8>mtext(text = "Minimal Risk MV Portfolio", side = 3, line = 1.5,

9+ font = 2, cex = 0.7, adj = 0)

10>covRiskBudgetsPie(minriskPortfolio, radius = 0.7, col = col)

11>mtext(text = "Minimal Risk MV Portfolio", side = 3, line = 1.5,

12+ font = 2, cex = 0.7, adj = 0)

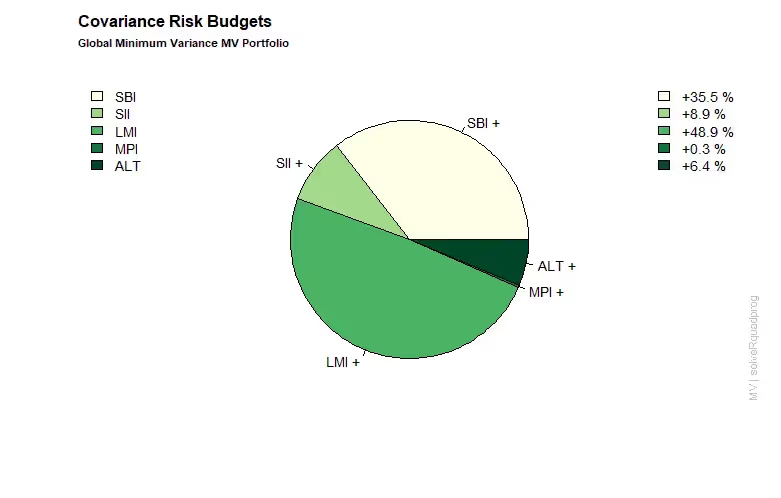

Global minimum variance portfolio

This portfolio finds the best asset allocation with the lowest possible return variance (minimum risk).

1>globminSpec <- portfolioSpec()

2>globminPortfolio <- minvariancePortfolio(

3+ data = lppData,

4+ spec = globminSpec,

5+ constraints = "LongOnly")

6>print(globminPortfolio)

7

8Title:

9 MV Minimum Variance Portfolio

10 Estimator: covEstimator

11 Solver: solveRquadprog

12 Optimize: minRisk

13 Constraints: LongOnly

14

15Portfolio Weights:

16 SBI SPI SII LMI MPI ALT

170.3555 0.0000 0.0890 0.4893 0.0026 0.0636

18

19Covariance Risk Budgets:

20 SBI SPI SII LMI MPI ALT

210.3555 0.0000 0.0890 0.4893 0.0026 0.0636

22

23Target Returns and Risks:

24 mean Cov CVaR VaR

250.0105 0.0986 0.2020 0.1558

In our final step we generate the plots for the global minimum mean-variance portfolio.

1>col <- seqPalette(ncol(lppData), "YlGn")

2>weightsPie(globminPortfolio, box = FALSE, col = col)

3>mtext(text = "Global Minimum Variance MV Portfolio", side = 3,

4line = 1.5, font = 2, cex = 0.7, adj = 0)

5>weightedReturnsPie(globminPortfolio, box = FALSE, col = col)

6>mtext(text = "Global Minimum Variance MV Portfolio", side = 3,

7line = 1.5, font = 2, cex = 0.7, adj = 0)

8>covRiskBudgetsPie(globminPortfolio, box = FALSE, col = col)

9>mtext(text = "Global Minimum Variance MV Portfolio", side = 3,

10line = 1.5, font = 2, cex = 0.7, adj = 0)

Case study portfolio optimization

For our real world example we are going to optimize a portfolio of 30 stocks as given in the Dow Jones Index. First we need to load our data set which can be found in the fBasics package.

1>djiData <- as.timeSeries(DowJones30)

2>djiData.ret <- 100 * returns(djiData)

3>colnames(djiData)

4 [1] "AA" "AXP" "T" "BA" "CAT" "C" "KO" "DD" "EK" "XOM" "GE" "GM" "HWP"

5[14] "HD" "HON" "INTC" "IBM" "IP" "JPM" "JNJ" "MCD" "MRK" "MSFT" "MMM" "MO" "PG"

6[27] "SBC" "UTX" "WMT" "DIS"

7>c(start(djiData), end(djiData))

8GMT

9[1] [1990-12-31] [2001-01-02]

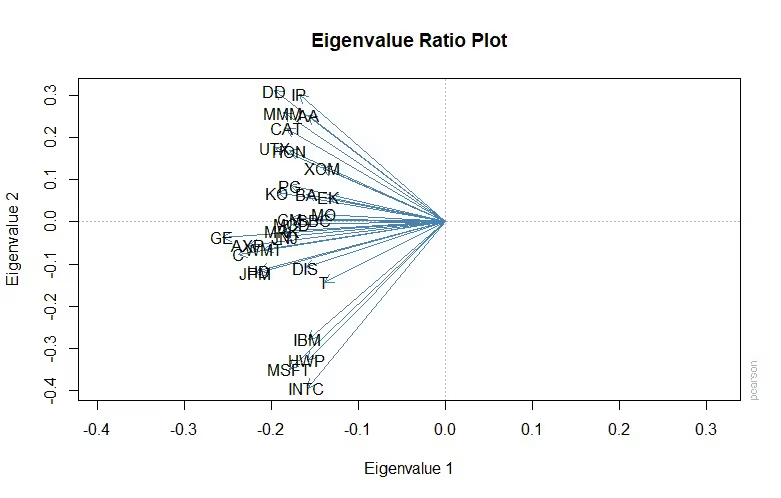

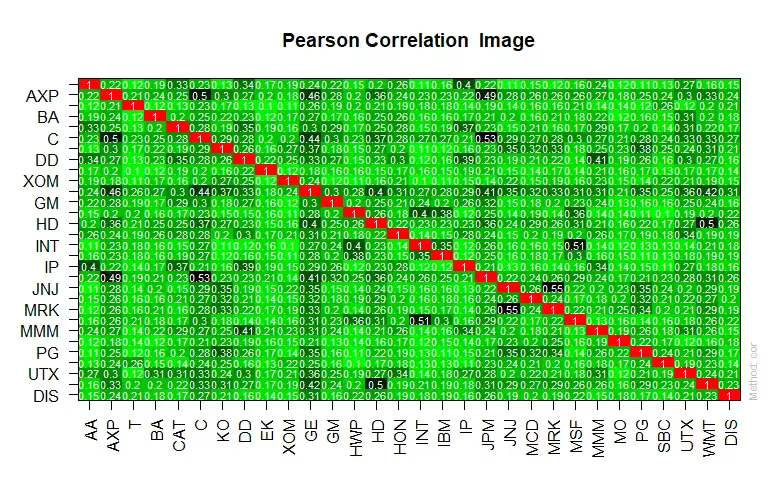

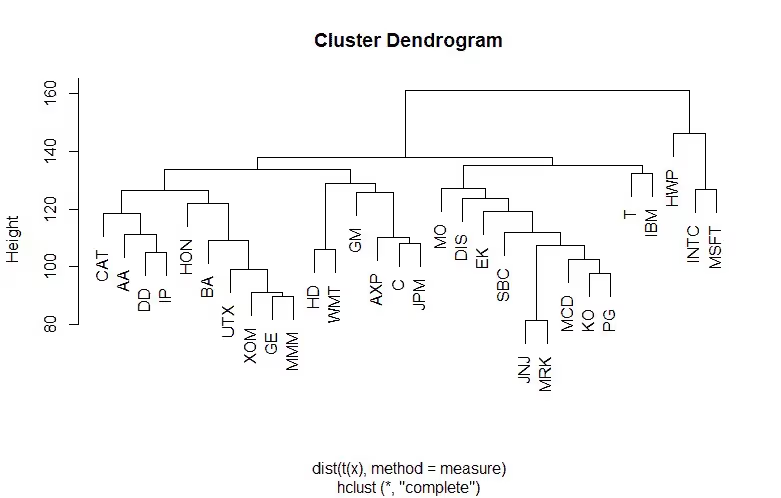

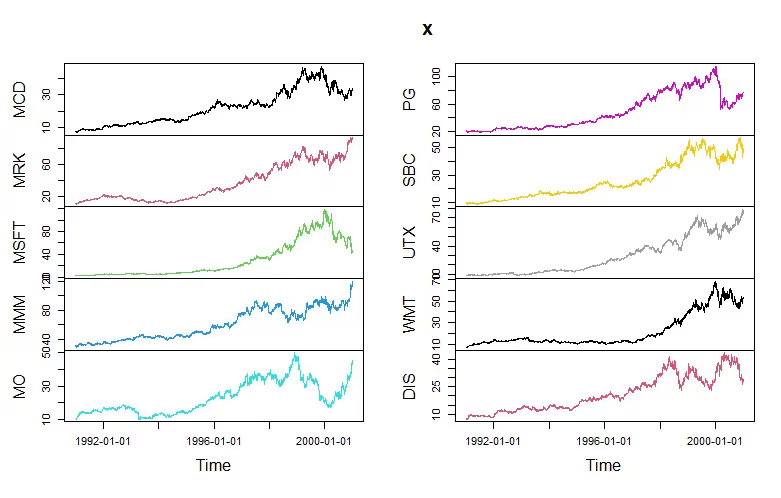

We explore the returns series, investigate pairwise dependencies and the distributional properties from a star plot. With hierarchical clustering and PCA analysis we can find out on whether the stocks are similar or not. To investigate all of these properties we can plot the data and visualize the dependencies with the following code.

1>library(fPortfolio)

2>for (i in 1:3) plot(djiData.ret[, (10 * i - 9):(10 * i)])

3>for (i in 1:3) plot(djiData[, (10 * i - 9):(10 * i)])

4>assetsCorImagePlot(djiData.ret)

5>plot(assetsSelect(djiData.ret))

6>assetsCorEigenPlot(djiData.ret)

Output:

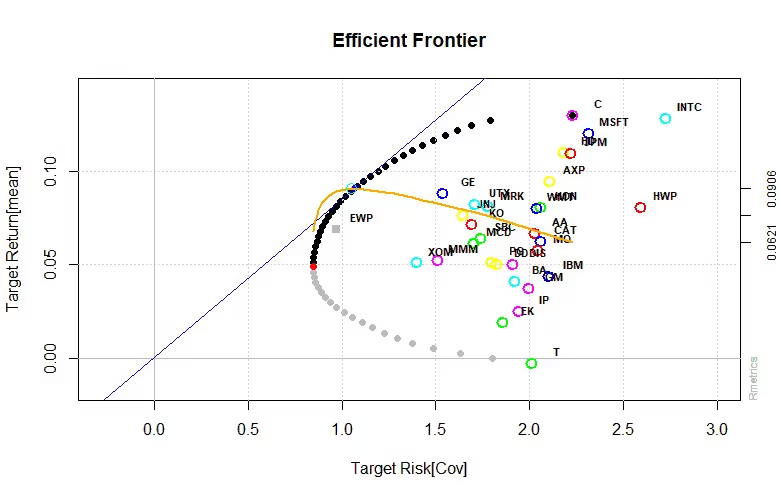

Applying the mean-variance portfolio approach we can find the optimal weights for a long only MV portfolio.

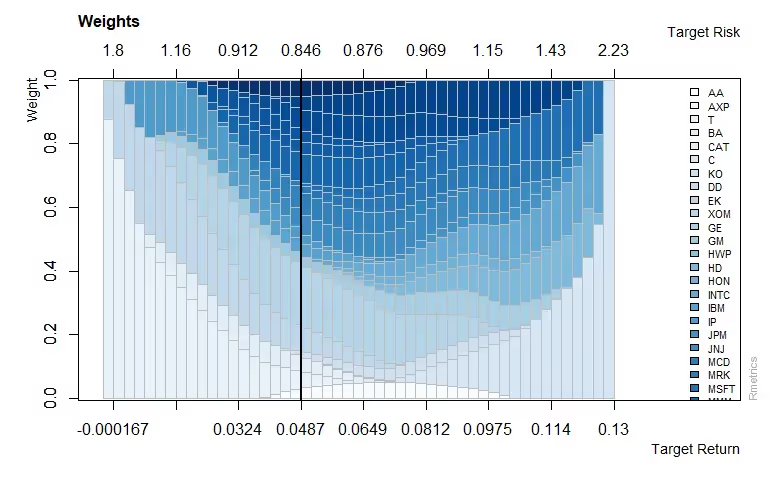

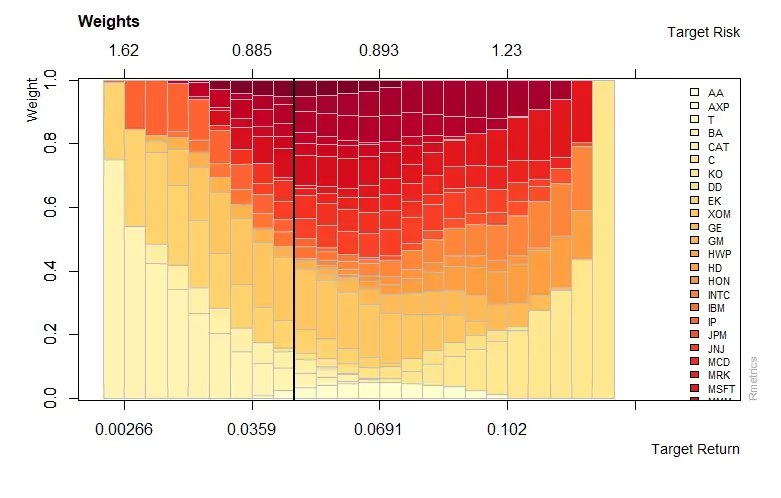

To find the optimal weights for a group-constrained MV portfolio equity clustering is performed. The data is grouped into 5 clusters. A maximum of 50% is invested in each cluster. Clustering is one of the most common exploratory data analysis techniques used to get an intuition about the structure of the data. For our example we use the k-means algorithm. The algorithms modus operandi is to try and make the intra-cluster data points as similar as possible while also keeping the clusters as different (far) as possible. It assigns data points to a cluster such that the sum of the squared distance between the data points and the cluster’s arithmetic mean of all the data points that belong to that cluster is at the minimum. Less variation within clusters means a higher degree of similarity between the data points within the same cluster.

1>selection <- assetsSelect(djiData.ret, method = "kmeans")

2>cluster <- selection$cluster

3>cluster[cluster == 1]

4AXP C HD JPM WMT

5 1 1 1 1 1

6>cluster[cluster == 2]

7INTC MSFT

8 2 2

9>cluster[cluster == 3]

10HWP IBM

11 3 3

12>cluster[cluster == 4]

13 AA BA CAT DD GM HON IP MMM UTX

14 4 4 4 4 4 4 4 4 4

15>cluster[cluster == 5]

16 T KO EK XOM GE JNJ MCD MRK MO PG SBC DIS

17 5 5 5 5 5 5 5 5 5 5 5 5

18>constraints <- c(

19+ 'maxsumW[c("BA","DD","EK","XOM","GM","HON","MMM","UTX")] = 0.30',

20+ 'maxsumW[c(T","KO","GE","HD","JNJ","MCD","MRK","MO","PG","SBC","WMT","DIS")] = 0.30',

21+ 'maxsumW[c(AXP","C","JPM")] = 0.30',

22+ 'maxsumW[c(AA","CAT","IP")] = 0.30',

23+ 'maxsumW[c(HWP","INTC","IBM","MSFT")] = 0.30')

24>djiSpec <- portfolioSpec()

25>setNFrontierPoints(djiSpec) <- 25

26>setEstimator(djiSpec) <- "shrinkEstimator"

27>djiFrontier <- portfolioFrontier(djiData.ret, djiSpec)

28>col = seqPalette(30, "YlOrRd")

29>weightsPlot(djiFrontier, col = col)

Output:

The graph shows the mean-variance frontier for the Dow Jones Index. By using the shrinkage estimator and by computing the weights along the frontier we estimate the covariance matrix.

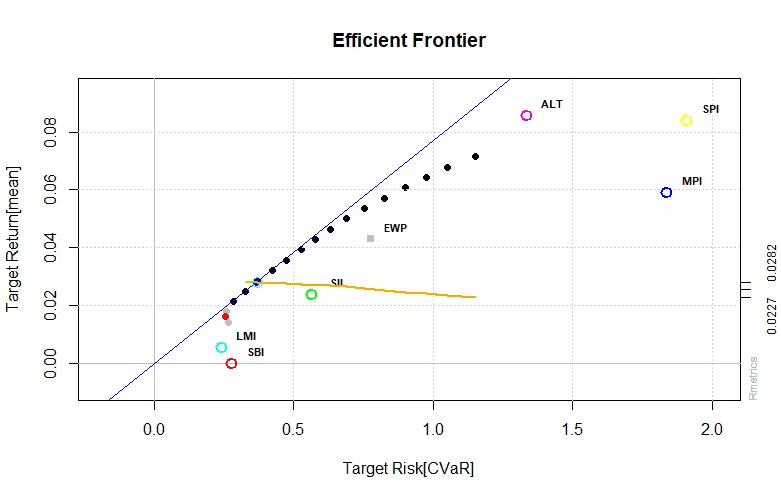

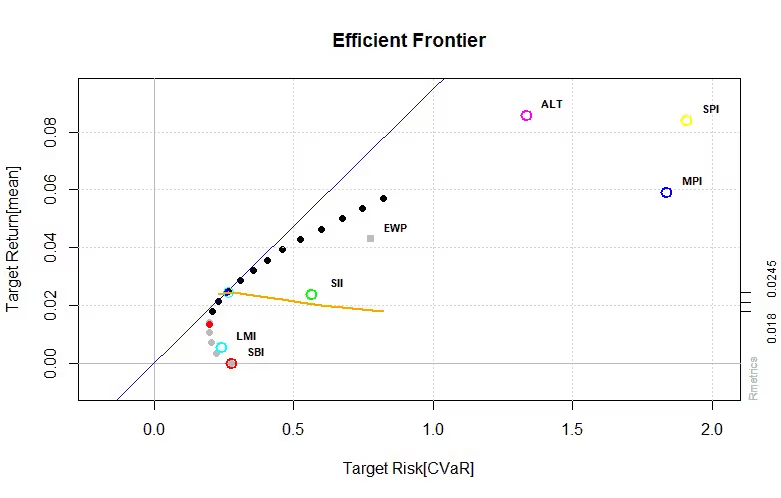

Mean-CVar portfolio optimization

Portfolio optimization is one of the most important problems from the past that has attracted the attention of investors. In this section we explore mean-CVar portfolio optimization as an alternative approach. Another name for Conditional Value at Risk (CVaR) is Expected Shortfall (ES). Compared to Value at Risk, ES is more sensitive to the tail behavior of the P&L distribution function.

First we select two assets with the smallest and largest returns and divide their range into equidistant parts which determine the target returns for which we try to find efficient portfolios. We compare unlimited short, long-only, box and group constrained efficient frontiers of mean-CVar portfolios.

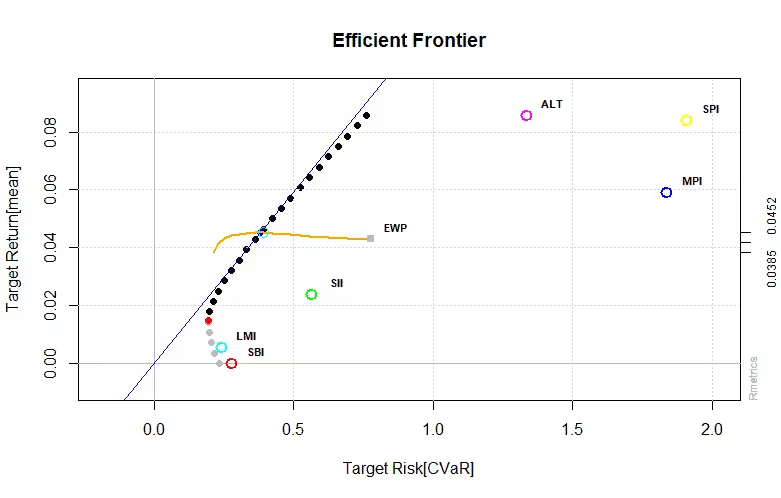

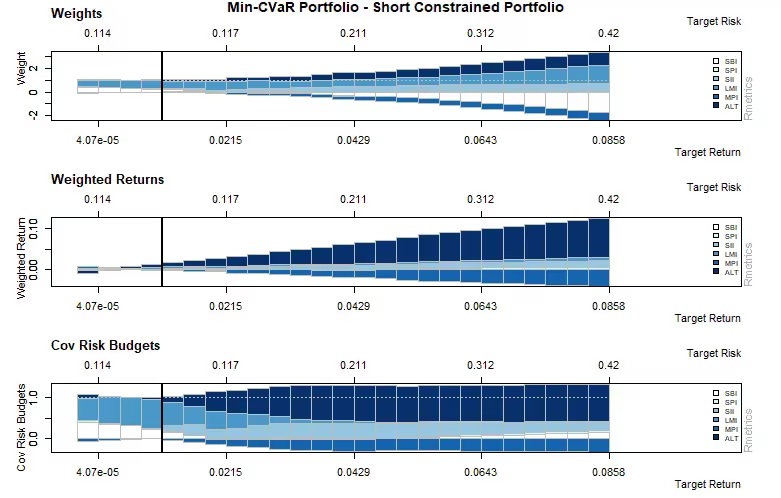

Unlimited short portfolio

When weights are not restricted we have unlimited short selling. This kind of portfolio cannot be optimized analytically therefore we need to define box constraints with larger lower and upper bounds to circumvent this limitation.

1>setNFrontierPoints(shortSpec) <- 5

2>setSolver(shortSpec) <- "solveRglpk.CVAR"

3>shortFrontier <- portfolioFrontier(data = lppData, spec = shortSpec,

4+ constraints = shortConstraints)

5>print(shortFrontier)

6

7Title:

8 CVaR Portfolio Frontier

9 Estimator: covEstimator

10 Solver: solveRglpk.CVAR

11 Optimize: minRisk

12 Constraints: minW maxW

13 Portfolio Points: 5 of 5

14 VaR Alpha: 0.05

15

16Portfolio Weights:

17 SBI SPI SII LMI MPI ALT

181 0.4257 -0.0242 0.0228 0.5661 0.0913 -0.0816

192 -0.0201 -0.0101 0.1746 0.7134 -0.0752 0.2174

203 -0.3275 -0.0196 0.4318 0.6437 -0.2771 0.5486

214 -0.8113 0.0492 0.5704 0.8687 -0.5273 0.8503

225 -1.6975 0.0753 0.6305 1.5485 -0.6683 1.1115

23

24Covariance Risk Budgets:

25 SBI SPI SII LMI MPI ALT

261 0.4056 0.0256 0.0062 0.5384 -0.0730 0.0972

272 -0.0080 -0.0173 0.2124 0.4559 -0.1256 0.4825

283 0.0054 -0.0204 0.3674 0.0592 -0.2787 0.8671

294 0.0572 0.0409 0.2901 0.0223 -0.2984 0.8880

305 0.1513 0.0510 0.1966 0.0215 -0.3235 0.9031

31

32Target Returns and Risks:

33 mean Cov CVaR VaR

341 0.0000 0.1136 0.2329 0.1859

352 0.0215 0.1172 0.2118 0.1733

363 0.0429 0.2109 0.3610 0.2923

374 0.0643 0.3121 0.5570 0.4175

385 0.0858 0.4201 0.7620 0.5745

39

40>setNFrontierPoints(shortSpec) <- 25

41>shortFrontier <- portfolioFrontier(data = lppData, spec = shortSpec,

42+ constraints = shortConstraints)

43>tailoredFrontierPlot(object = shortFrontier, mText = "Mean-CVaR Portfolio - Short Constraints",

44+ risk = "CVaR")

45>par(mfrow = c(3, 1), mar = c(3.5, 4, 4, 3) + 0.1)

46>weightsPlot(shortFrontier)

47>text <- "Min-CVaR Portfolio - Short Constrained Portfolio"

48>mtext(text, side = 3, line = 3, font = 2, cex = 0.9)

49>weightedReturnsPlot(shortFrontier)

50>covRiskBudgetsPlot(shortFrontier)

Output:

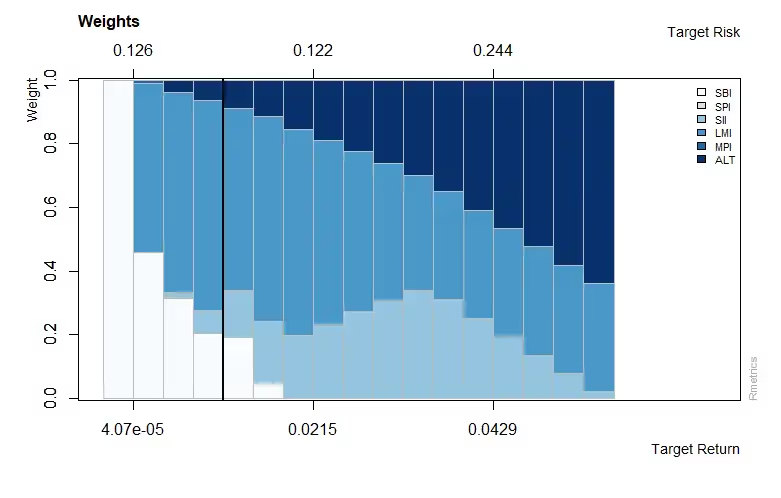

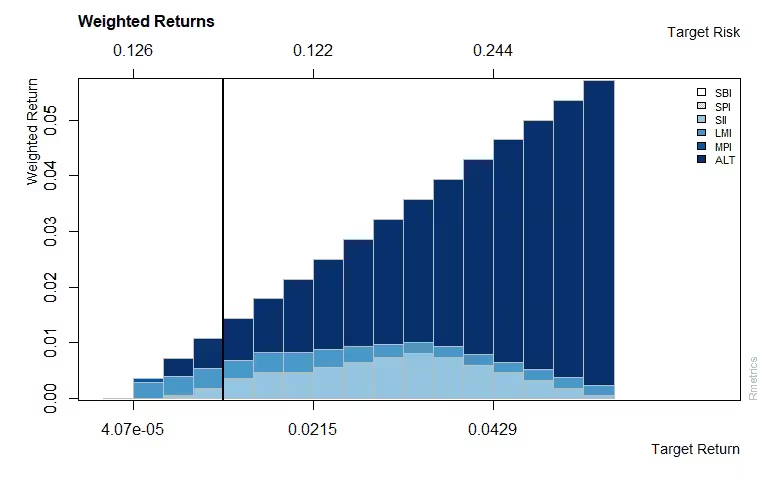

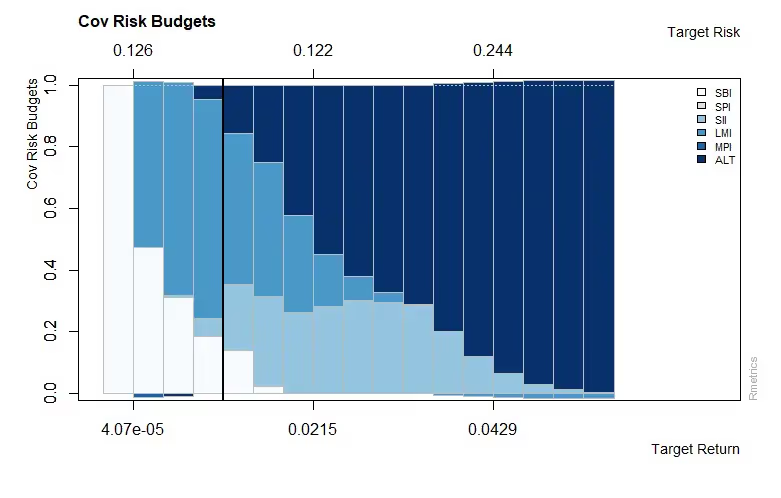

As shown in the graph above risk is lowered through short selling while keeping the same return.

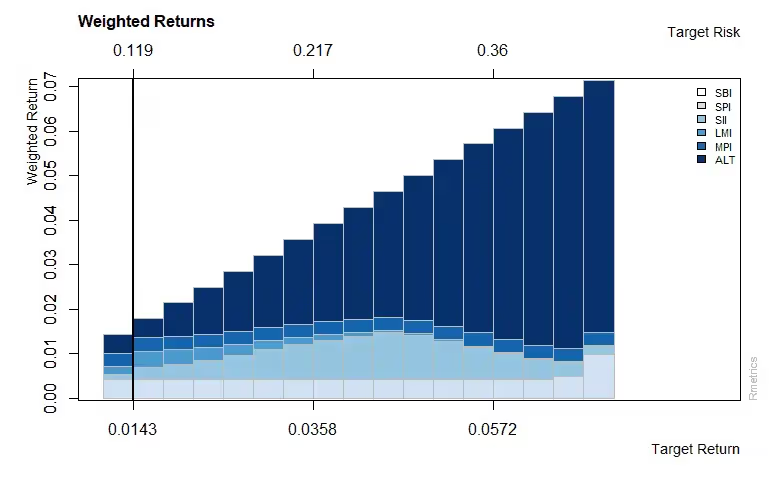

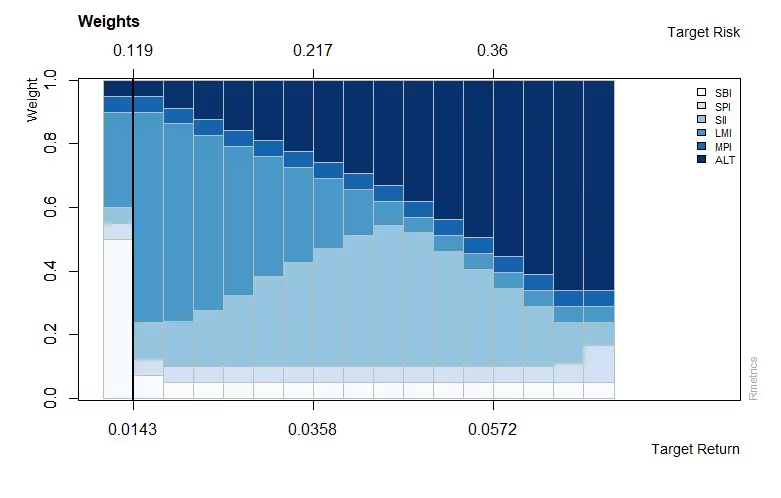

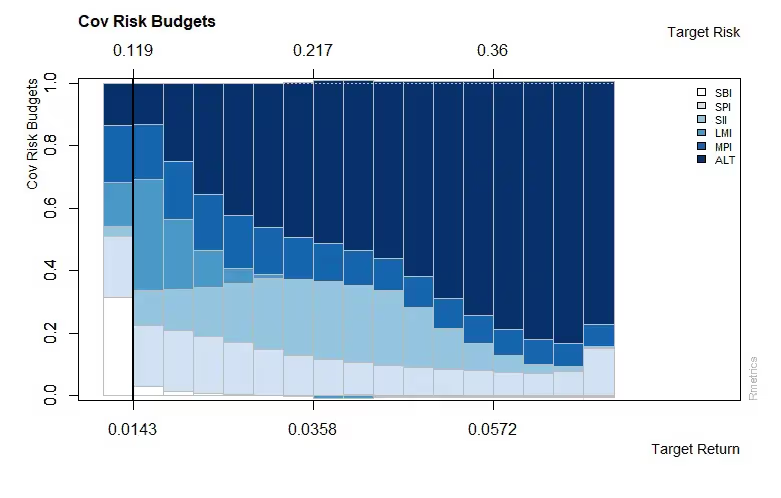

The graph above shows the weighted returns and covariance risk budgets, along the minimum variance locus and the efficient frontier.

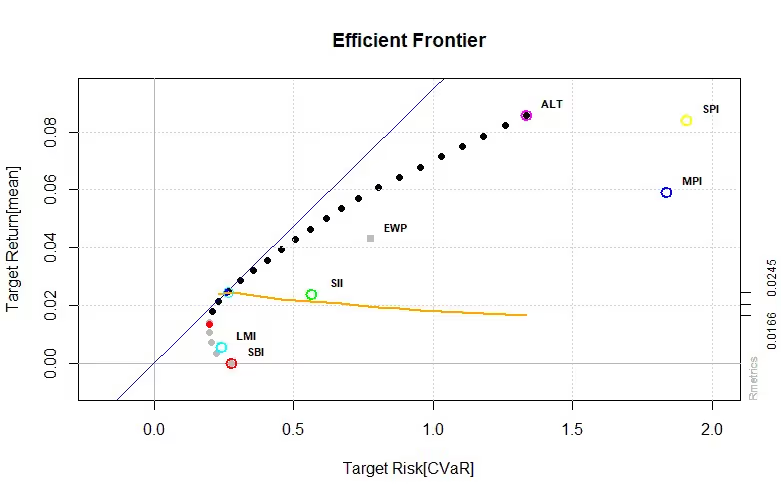

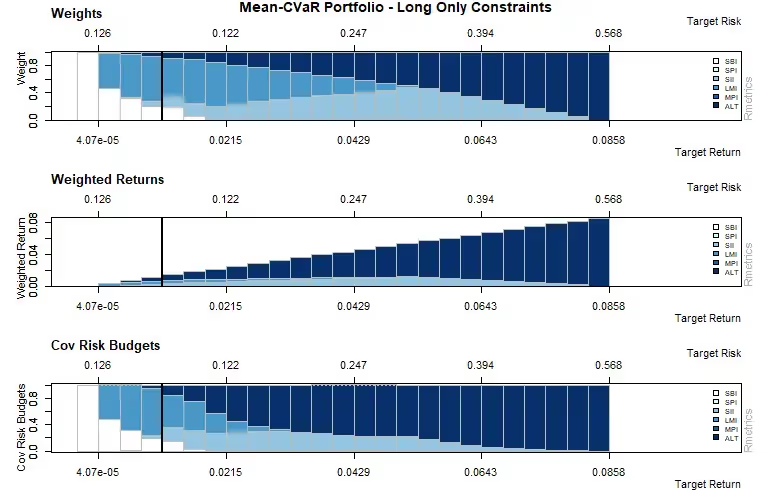

Long only portfolio

For the long only portfolio the weights are bounded between 0 and 1. To compute the efficient frontier of linearly constrained mean-cvar portfolios we can use following functions:

- portfolioFrontier: efficient portfolios on the frontier

- frontierPoints: extracts risk/return frontier points

- frontierPlot: creates an efficient frontier plot

- cmlPoints: adds market portfolio

- cmlLines: adds capital market line

- tangencyPoints: adds tangency portfolio point

- tangencyLines: adds tangency line

- equalWeightsPoints: adds point of equal weights portfolio

- singleAssetPoints: adds points of single asset portfolios

- twoAssetsLines: adds frontiers of two assets portfolios

- sharpeRatioLines: adds Sharpe ratio line

- monteCarloPoints: adds randomly feasible portfolios

- weightsPlot: weights bar plot along the frontier

- weightedReturnsPlot: weighted returns bar plot

- covRiskBudgetsPlot: covariance risk budget bar plot

1>lppData <- 100 * LPP2005.RET[, 1:6]

2>longSpec <- portfolioSpec()

3>setType(longSpec) <- "CVaR"

4Solver set to solveRquadprog

5setSolver: solveRglpk

6>setAlpha(longSpec) <- 0.05

7>setNFrontierPoints(longSpec) <- 5

8>setSolver(longSpec) <- "solveRglpk.CVAR"

9>longFrontier <- portfolioFrontier(data = lppData, spec = longSpec,

10+ constraints = "LongOnly")

11> print(longFrontier)

12

13Title:

14 CVaR Portfolio Frontier

15 Estimator: covEstimator

16 Solver: solveRglpk.CVAR

17 Optimize: minRisk

18 Constraints: LongOnly

19 Portfolio Points: 5 of 5

20 VaR Alpha: 0.05

21

22Portfolio Weights:

23 SBI SPI SII LMI MPI ALT

241 1.0000 0.0000 0.0000 0.0000 0.0000 0.0000

252 0.0000 0.0000 0.1988 0.6480 0.0000 0.1532

263 0.0000 0.0000 0.3835 0.2385 0.0000 0.3780

274 0.0000 0.0000 0.3464 0.0000 0.0000 0.6536

285 0.0000 0.0000 0.0000 0.0000 0.0000 1.0000

29

30Covariance Risk Budgets:

31 SBI SPI SII LMI MPI ALT

321 1.0000 0.0000 0.0000 0.0000 0.0000 0.0000

332 0.0000 0.0000 0.2641 0.3126 0.0000 0.4233

343 0.0000 0.0000 0.2432 -0.0101 0.0000 0.7670

354 0.0000 0.0000 0.0884 0.0000 0.0000 0.9116

365 0.0000 0.0000 0.0000 0.0000 0.0000 1.0000

37

38Target Returns and Risks:

39 mean Cov CVaR VaR

401 0.0000 0.1261 0.2758 0.2177

412 0.0215 0.1224 0.2313 0.1747

423 0.0429 0.2472 0.5076 0.3337

434 0.0643 0.3941 0.8780 0.5830

445 0.0858 0.5684 1.3343 0.8978

The printout lists portfolio weights, covariance risk budgets and target returns and risks along the efficient frontier. Target returns and risks are sorted starting with the portfolio with the lowest return and ending with the portfolio showing the highest return. By repeating the optimization with 25 points at the frontier we can plot the efficient frontier and the results.

Box constrained portfolio

As the name suggests box-constrained portfolios specify upper and lower bounds on the asset weights.

1>boxSpec <- portfolioSpec()

2>setType(boxSpec) <- "CVaR"

3Solver set to solveRquadprog

4setSolver: solveRglpk

5>setAlpha(boxSpec) <- 0.05

6>setNFrontierPoints(boxSpec) <- 15

7>setSolver(boxSpec) <- "solveRglpk.CVAR"

8>boxConstraints <- c("minW[1:6]=0.05", "maxW[1:6]=0.66")

9>boxFrontier <- portfolioFrontier(data = lppData, spec = boxSpec, constraints = boxConstraints)

10>print(boxFrontier)

11

12Title:

13 CVaR Portfolio Frontier

14 Estimator: covEstimator

15 Solver: solveRglpk.CVAR

16 Optimize: minRisk

17 Constraints: minW maxW

18 Portfolio Points: 5 of 9

19 VaR Alpha: 0.05

20

21Portfolio Weights:

22 SBI SPI SII LMI MPI ALT

231 0.0526 0.0500 0.1370 0.6600 0.0500 0.0504

243 0.0500 0.0500 0.2633 0.4127 0.0500 0.1739

255 0.0500 0.0500 0.4109 0.1463 0.0500 0.2928

267 0.0500 0.0500 0.3378 0.0500 0.0500 0.4622

279 0.0500 0.0501 0.1399 0.0500 0.0500 0.6600

28

29Covariance Risk Budgets:

30 SBI SPI SII LMI MPI ALT

311 0.0189 0.1945 0.1435 0.3378 0.1742 0.1312

323 0.0023 0.1528 0.2209 0.0248 0.1582 0.4410

335 -0.0017 0.1042 0.2478 -0.0080 0.1136 0.5440

347 -0.0024 0.0823 0.1099 -0.0035 0.0931 0.7206

359 -0.0022 0.0650 0.0182 -0.0031 0.0752 0.8469

36

37Target Returns and Risks:

38 mean Cov CVaR VaR

391 0.0184 0.1232 0.2604 0.1913

403 0.0307 0.1838 0.3999 0.2651

415 0.0429 0.2655 0.5787 0.3654

427 0.0552 0.3456 0.7832 0.4818

439 0.0674 0.4388 1.0382 0.6675

44

45Description:

46 Thu Jan 28 11:54:41 2021 by user: 1

47>setNFrontierPoints(boxSpec) <- 25

48>boxFrontier <- portfolioFrontier(data = lppData, spec = boxSpec,

49+ constraints = boxConstraints)

50>tailoredFrontierPlot(object = boxFrontier, mText = "Mean-CVaR Portfolio - Box Constraints",

51+ risk = "CVaR")

52>weightsPlot(boxFrontier)

53>text <- "Min-CVaR Portfolio - Box Constrained Portfolio"

54>mtext(text, side = 3, line = 3, font = 2, cex = 0.9)

55>weightedReturnsPlot(boxFrontier)

56>covRiskBudgetsPlot(boxFrontier)

Output:

Group constrained portfolio

In a group constrained portfolio the weights of groups are constrained by lower and upper bounds.

1> groupSpec <- portfolioSpec()

2> setType(groupSpec) <- "CVaR"

3Solver set to solveRquadprog

4setSolver: solveRglpk

5> setAlpha(groupSpec) <- 0.05

6> setNFrontierPoints(groupSpec) <- 10

7> setSolver(groupSpec) <- "solveRglpk.CVAR"

8> groupConstraints <- c("minsumW[c(1,4)]=0.3", "maxsumW[c(2:3,5:6)]=0.66")

9> groupFrontier <- portfolioFrontier(data = lppData, spec = groupSpec,

10+ constraints = groupConstraints)

11> print(groupFrontier)

12

13Title:

14 CVaR Portfolio Frontier

15 Estimator: covEstimator

16 Solver: solveRglpk.CVAR

17 Optimize: minRisk

18 Constraints: minsumW maxsumW

19 Portfolio Points: 5 of 7

20 VaR Alpha: 0.05

21

22Portfolio Weights:

23 SBI SPI SII LMI MPI ALT

241 1.0000 0.0000 0.0000 0.0000 0.0000 0.0000

252 0.2440 0.0000 0.0410 0.6574 0.0000 0.0576

264 0.0000 0.0000 0.2744 0.5007 0.0000 0.2249

275 0.0000 0.0000 0.3288 0.3400 0.0000 0.3312

287 0.0000 0.0000 0.0209 0.3400 0.0000 0.6391

29

30Covariance Risk Budgets:

31 SBI SPI SII LMI MPI ALT

321 1.0000 0.0000 0.0000 0.0000 0.0000 0.0000

332 0.2294 0.0000 0.0218 0.7226 0.0000 0.0263

344 0.0000 0.0000 0.3024 0.0780 0.0000 0.6196

355 0.0000 0.0000 0.2388 -0.0024 0.0000 0.7636

367 0.0000 0.0000 0.0020 -0.0159 0.0000 1.0139

37

38Target Returns and Risks:

39 mean Cov CVaR VaR

401 0.0000 0.1261 0.2758 0.2177

412 0.0096 0.1012 0.2003 0.1622

424 0.0286 0.1575 0.3076 0.2178

435 0.0381 0.2147 0.4392 0.2783

447 0.0572 0.3559 0.8228 0.5517

45

46> setNFrontierPoints(groupSpec) <- 25

47> groupFrontier <- portfolioFrontier(data = lppData, spec = groupSpec,

48+ constraints = groupConstraints)

49> tailoredFrontierPlot(object = groupFrontier, mText = "Mean-CVaR Portfolio - Group Constraints",

50+ risk = "CVaR")

51> weightsPlot(groupFrontier)

52> text <- "Min-CVaR Portfolio - Group Constrained Portfolio"

53> mtext(text, side = 3, line = 3, font = 2, cex = 0.9)

54> weightedReturnsPlot(groupFrontier)

55> covRiskBudgetsPlot(groupFrontier)

Output:

Portfolio backtesting

For backtesting a portfolio it is common practice to test your strategy performance over a long time frame that encompasses different types of market conditions. We use the S4 object class fPFOLIOBACKTEST to run our backtest. The object of class fPFOLIOBACKTEST has four slots:

@windows

a list, setting the windows function that defines the rolling windows, and the set of window specific parameters params. E.g The window horizon is set as a parameter horizon = "24m"

@strategy

a list, setting the portfolio strategy to implement during the backtest, and any strategy specific parameters are found in params.

@smoother

a list, specifying the smoothing style, given as a smoother function, and any smoother specific parameters are stored in the list params.

@messages

a list, any messages collected during the backtest

We can set the backtest settings with the function portfolioBacktest().

1>library(fPortfolio)

2>showClass("fPFOLIOBACKTEST")

3Class "fPFOLIOBACKTEST" [package "fPortfolio"]

4

5Slots:

6

7Name: windows strategy smoother messages

8Class: list list list list

9>formals(portfolioBacktest)

10$windows

11list(windows = "equidistWindows", params = list(horizon = "12m"))

12

13$strategy

14list(strategy = "tangencyStrategy", params = list())

15

16$smoother

17list(smoother = "emaSmoother", params = list(doubleSmoothing = TRUE,

18 lambda = "3m", skip = 0, initialWeights = NULL))

19

20$messages

21list()

The above code shows you the default settings for the portfolioBacktest() function consisting of a tangency portfolio strategy, equidistant windows with a horizon of 12 months and a double exponential moving average smoother. To create a new backtest function and print the structure for the default settings we can do the following:

1>backtest <- portfolioBacktest()

2>str(backtest, width = 65, strict.width = "cut")

3Formal class 'fPFOLIOBACKTEST' [package "fPortfolio"] with 4 sl..

4 ..@ windows :List of 2

5 .. ..$ windows: chr "equidistWindows"

6 .. ..$ params :List of 1

7 .. .. ..$ horizon: chr "12m"

8 ..@ strategy:List of 2

9 .. ..$ strategy: chr "tangencyStrategy"

10 .. ..$ params : list()

11 ..@ smoother:List of 2

12 .. ..$ smoother: chr "emaSmoother"

13 .. ..$ params :List of 4

14 .. .. ..$ doubleSmoothing: logi TRUE

15 .. .. ..$ lambda : chr "3m"

16 .. .. ..$ skip : num 0

17 .. .. ..$ initialWeights : NULL

18 ..@ messages: list()

@windows slot:

The slot consists of two named entries. The rolling windows function defines the backtest windows and the second slot named params holds the parameters, for example the horizon of windows.

@windows SLOT OF AN fPFOLIOBACKTEST OBJECT extractor functions:

getWindows: gets windows slot

getWindowsFun: gets windows function

getWindowsParams: gets windows specific parameters

getWindowsHorizon: gets windows horizon

With the constructor functions we can modify the settings for the portfolio backtest specifications.

Constructor Functions

setWindowsFun: sets the name of the windows function

setWindowsParams: sets parameters for the windows function

setWindowsHorizon: sets the windows horizon measured in months

The default rolling windows can be inspected with following code.

1>defaultBacktest <- portfolioBacktest()

2>getWindowsFun(defaultBacktest)

3[1] "equidistWindows"

4>getWindowsParams(defaultBacktest)

5$horizon

6[1] "12m"

7

8> getWindowsHorizon(defaultBacktest)

9[1] "12m"

10> args(equidistWindows)

11function (data, backtest = portfolioBacktest())

12NULL

13> equidistWindows

14function (data, backtest = portfolioBacktest())

15{

16 horizon = getWindowsHorizon(backtest)

17 ans = rollingWindows(x = data, period = horizon, by = "1m")

18 ans

19}

20<bytecode: 0x000001ff58ed37b8>

21<environment: namespace:fPortfolio>

The function getWindowsHorizton() extracts the horizon which is the length of the windows. The function rollingWindows() creates the windows returning a list with two entries named from and to. Both of the list entries give the start and end dates of the whole series.

1>swxData <- 100 * SWX.RET

2>swxBacktest <- portfolioBacktest()

3>setWindowsHorizon(swxBacktest) <- "24m"

4>equidistWindows(data = swxData, backtest = swxBacktest)

5$from

6GMT

7 [1] [2000-01-01] [2000-02-01] [2000-03-01] [2000-04-01] [2000-05-01] [2000-06-01] [2000-07-01]

8 [8] [2000-08-01] [2000-09-01] [2000-10-01] [2000-11-01] [2000-12-01] [2001-01-01] [2001-02-01]

9[15] [2001-03-01] [2001-04-01] [2001-05-01] [2001-06-01] [2001-07-01] [2001-08-01] [2001-09-01]

10[22] [2001-10-01] [2001-11-01] [2001-12-01] [2002-01-01] [2002-02-01] [2002-03-01] [2002-04-01]

11[29] [2002-05-01] [2002-06-01] [2002-07-01] [2002-08-01] [2002-09-01] [2002-10-01] [2002-11-01]

12[36] [2002-12-01] [2003-01-01] [2003-02-01] [2003-03-01] [2003-04-01] [2003-05-01] [2003-06-01]

13[43] [2003-07-01] [2003-08-01] [2003-09-01] [2003-10-01] [2003-11-01] [2003-12-01] [2004-01-01]

14[50] [2004-02-01] [2004-03-01] [2004-04-01] [2004-05-01] [2004-06-01] [2004-07-01] [2004-08-01]

15[57] [2004-09-01] [2004-10-01] [2004-11-01] [2004-12-01] [2005-01-01] [2005-02-01] [2005-03-01]

16[64] [2005-04-01] [2005-05-01] [2005-06-01]

17

18$to

19GMT

20 [1] [2001-12-31] [2002-01-31] [2002-02-28] [2002-03-31] [2002-04-30] [2002-05-31] [2002-06-30]

21 [8] [2002-07-31] [2002-08-31] [2002-09-30] [2002-10-31] [2002-11-30] [2002-12-31] [2003-01-31]

22[15] [2003-02-28] [2003-03-31] [2003-04-30] [2003-05-31] [2003-06-30] [2003-07-31] [2003-08-31]

23[22] [2003-09-30] [2003-10-31] [2003-11-30] [2003-12-31] [2004-01-31] [2004-02-29] [2004-03-31]

24[29] [2004-04-30] [2004-05-31] [2004-06-30] [2004-07-31] [2004-08-31] [2004-09-30] [2004-10-31]

25[36] [2004-11-30] [2004-12-31] [2005-01-31] [2005-02-28] [2005-03-31] [2005-04-30] [2005-05-31]

26[43] [2005-06-30] [2005-07-31] [2005-08-31] [2005-09-30] [2005-10-31] [2005-11-30] [2005-12-31]

27[50] [2006-01-31] [2006-02-28] [2006-03-31] [2006-04-30] [2006-05-31] [2006-06-30] [2006-07-31]

28[57] [2006-08-31] [2006-09-30] [2006-10-31] [2006-11-30] [2006-12-31] [2007-01-31] [2007-02-28]

29[64] [2007-03-31] [2007-04-30] [2007-05-31]

30

31attr(,"control")

32attr(,"control")$start

33GMT

34[1] [2000-01-04]

35

36attr(,"control")$end

37GMT

38[1] [2007-05-08]

39

40attr(,"control")$period

41[1] "24m"

42

43attr(,"control")$by

44[1] "1m"

To modify rolling window parameters we do the following.

1>setWindowsHorizon(backtest) <- "24m"

2>getWindowsParams(backtest)

3$horizon

4[1] "24m"

@strategy slot:

The @strategy slot consists of two named entries. The strategy entry holds the name of the strategy function that defines the portfolio strategy we want to backtest and the params entry holds the strategy parameters.

@strategy SLOT of an fPFOLIOBACKTEST object extractor functions:

getStrategy: gets strategy slot

getStrategyFun: gets the name of the strategy function

getStrategyParams: gets strategy specific parameters

Constructor functions:

setStrategyFun: sets the name of the strategy function

setStrategyParams: sets strategy specific parameters

We can inspect default portfolio strategy settingsby suing tangencyStrategy.

1>args(tangencyStrategy)

2function (data, spec = portfolioSpec(), constraints = "LongOnly",

3 backtest = portfolioBacktest())

4NULL

5

6#The following example invests in a strategy with the highest #Sharpe ratio, if such a portfolio is not found the minimum- #variance portfolio is taken instead.

7>tangencyStrategy

8function (data, spec = portfolioSpec(), constraints = "LongOnly",

9 backtest = portfolioBacktest())

10{

11 strategyPortfolio <- try(tangencyPortfolio(data, spec, constraints))

12 if (class(strategyPortfolio) == "try-error") {

13 strategyPortfolio <- minvariancePortfolio(data, spec,

14 constraints)

15 }

16 strategyPortfolio

17}

18<bytecode: 0x000001ff54cdb1c0>

19<environment: namespace:fPortfolio>

@smoother slot:

This is a list with two named entries. The entry named smoother holds the name of the smoother function. The function defines the backtest function to smooth the weights over time. The params entry holds the required parameters for the smoother function.

We can inspect the default smoother function with following code.

1>args(emaSmoother)

2function (weights, spec, backtest)

3NULL

4> emaSmoother

5function (weights, spec, backtest)

6{

7 ema <- function(x, lambda) {

8 x = as.vector(x)

9 lambda = 2/(lambda + 1)

10 xlam = x * lambda

11 xlam[1] = x[1]

12 ema = filter(xlam, filter = (1 - lambda), method = "rec")

13 ema[is.na(ema)] <- 0

14 as.numeric(ema)

15 }

16 lambda <- getSmootherLambda(backtest)

17 lambdaLength <- as.numeric(substr(lambda, 1, nchar(lambda) -

18 1))

19 lambdaUnit <- substr(lambda, nchar(lambda), nchar(lambda))

20 stopifnot(lambdaUnit == "m")

21 lambda <- lambdaLength

22 nAssets <- ncol(weights)

23 initialWeights = getSmootherInitialWeights(backtest)

24 if (!is.null(initialWeights))

25 weights[1, ] = initialWeights

26 smoothWeights1 = NULL

27 for (i in 1:nAssets) {

28 EMA <- ema(weights[, i], lambda = lambda)

29 smoothWeights1 <- cbind(smoothWeights1, EMA)

30 }

31 doubleSmooth <- getSmootherDoubleSmoothing(backtest)

32 if (doubleSmooth) {

33 smoothWeights = NULL

34 for (i in 1:nAssets) {

35 EMA <- ema(smoothWeights1[, i], lambda = lambda)

36 smoothWeights = cbind(smoothWeights, EMA)

37 }

38 }

39 else {

40 smoothWeights <- smoothWeights1

41 }

42 rownames(smoothWeights) <- rownames(weights)

43 colnames(smoothWeights) <- colnames(weights)

44 smoothWeights

45}

46<bytecode: 0x000001ff549db078>

47<environment: namespace:fPortfolio>

With the setSmoother functions we can modify the control parameters.

1#Change single smoothing type

2>setSmootherDoubleSmoothing(backtest) <- FALSE

3#Modify smoother's decay length

4> setSmootherLambda(backtest) <- "12m"

5#Start rebalancing 12 months after start date

6> setSmootherSkip(backtest) <- "12m"

7#Use equal weights as starting points

8> nAssets <- 5

9> setSmootherInitialWeights(backtest) <- rep(1/nAssets, nAssets)

10#Check your settings after making changes

11> getSmootherParams(backtest)

12$doubleSmoothing

13[1] FALSE

14

15$lambda

16[1] "12m"

17

18$skip

19[1] "12m"

20

21$initialWeights

22[1] 0.2 0.2 0.2 0.2 0.2

Backtesting sector rotation portfolio

The SPI data is used for the purpose of this backtest. The swiss performance index is comprised of nine sectors: finance, technology, materials, consumer goods, industrials, health care, consumer services, utilities and telecommunications. The strategy uses a fixed rolling window of 12 months shifted in monthly intervals. Portfolio optimization is done via the mean-variance Markowitz method. The first thing we need to do is specify the portfolio data for the specification, for the constraints and for the portfolio backtest.

1>library(fPortfolio)

2>colnames(SPISECTOR.RET)

3 [1] "SPI" "BASI" "INDU" "CONG" "HLTH" "CONS" "TELE" "UTIL" "FINA" "TECH"

4>spiData <- SPISECTOR.RET

5>spiSpec <- portfolioSpec()

6>spiConstraints <- "LongOnly"

7>spiBacktest <- portfolioBacktest()

8

9#Specify assets for backtesting

10>spiFormula <- SPI ~ BASI + INDU + CONG + HLTH + CONS + TELE +

11+ UTIL + FINA + TECH

12

13#Optimize rolling portfolios and run backtests

14>spiPortfolios <- portfolioBacktesting(formula = spiFormula,

15+ data = spiData, spec = spiSpec, constraints = spiConstraints,

16+ backtest = spiBacktest, trace = FALSE)

17

18#Weights of first 12 months are rebalanced on a monthly basis

19>Weights <- round(100 * spiPortfolios$weights, 2)[1:12, ]

20>Weights

21 BASI INDU CONG HLTH CONS TELE UTIL FINA TECH

222000-12-31 0 0 48.08 0 0 0 27.54 16.06 8.33

232001-01-31 0 0 22.25 0 0 0 28.62 49.13 0.00

242001-02-28 0 0 31.15 0 0 0 32.80 36.05 0.00

252001-03-31 0 0 51.92 0 0 0 48.08 0.00 0.00

262001-04-30 0 0 39.77 0 0 0 46.70 13.53 0.00

272001-05-31 0 0 35.16 0 0 0 64.68 0.16 0.00

282001-06-30 0 0 47.84 0 0 0 52.16 0.00 0.00

292001-07-31 0 0 27.19 0 0 0 72.81 0.00 0.00

302001-08-31 0 0 0.00 0 0 0 100.00 0.00 0.00

312001-09-30 0 0 0.00 0 0 100 0.00 0.00 0.00

322001-10-31 0 0 0.00 0 0 100 0.00 0.00 0.00

332001-11-30 0 0 0.00 0 0 100 0.00 0.00 0.00

To reduce the costs of rebalancing to often we set the smoothing parameter lambda to 12 months. This way we increase the smoothing effect.

1>setSmootherLambda(spiPortfolios$backtest) <- "12m"

2>spiSmoothPortfolios <- portfolioSmoothing(object = spiPortfolios,

3+ trace = FALSE)

4>smoothWeights <- round(100 * spiSmoothPortfolios$smoothWeights,

5+ 2)[1:12, ]

6>smoothWeights

7 BASI INDU CONG HLTH CONS TELE UTIL FINA TECH

82000-12-31 0 0 48.08 0 0 0.00 27.54 16.06 8.33

92001-01-31 0 0 47.47 0 0 0.00 27.56 16.84 8.13

102001-02-28 0 0 46.64 0 0 0.00 27.70 17.86 7.80

112001-03-31 0 0 46.18 0 0 0.00 28.29 18.16 7.37

122001-04-30 0 0 45.70 0 0 0.00 29.14 18.27 6.89

132001-05-31 0 0 45.10 0 0 0.00 30.59 17.92 6.39

142001-06-30 0 0 44.74 0 0 0.00 32.15 17.24 5.88

152001-07-31 0 0 44.06 0 0 0.00 34.22 16.35 5.37

162001-08-31 0 0 42.54 0 0 0.00 37.26 15.32 4.88

172001-09-30 0 0 40.44 0 0 2.37 38.55 14.23 4.41

182001-10-31 0 0 37.98 0 0 6.37 38.57 13.11 3.98

192001-11-30 0 0 35.32 0 0 11.46 37.67 11.99 3.57

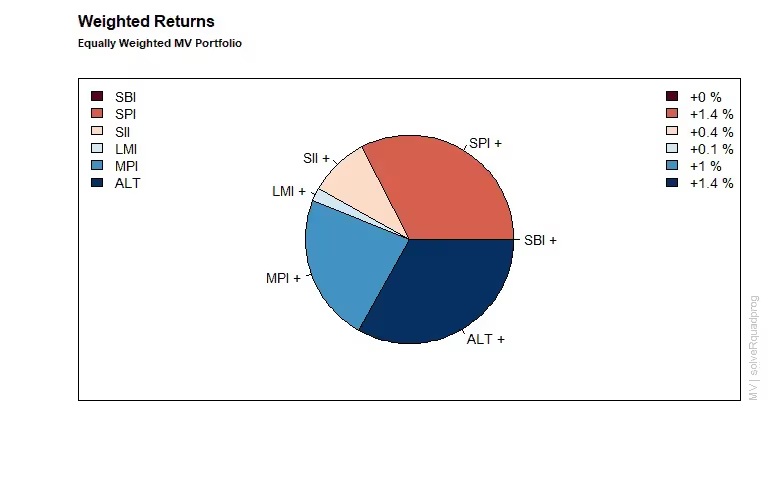

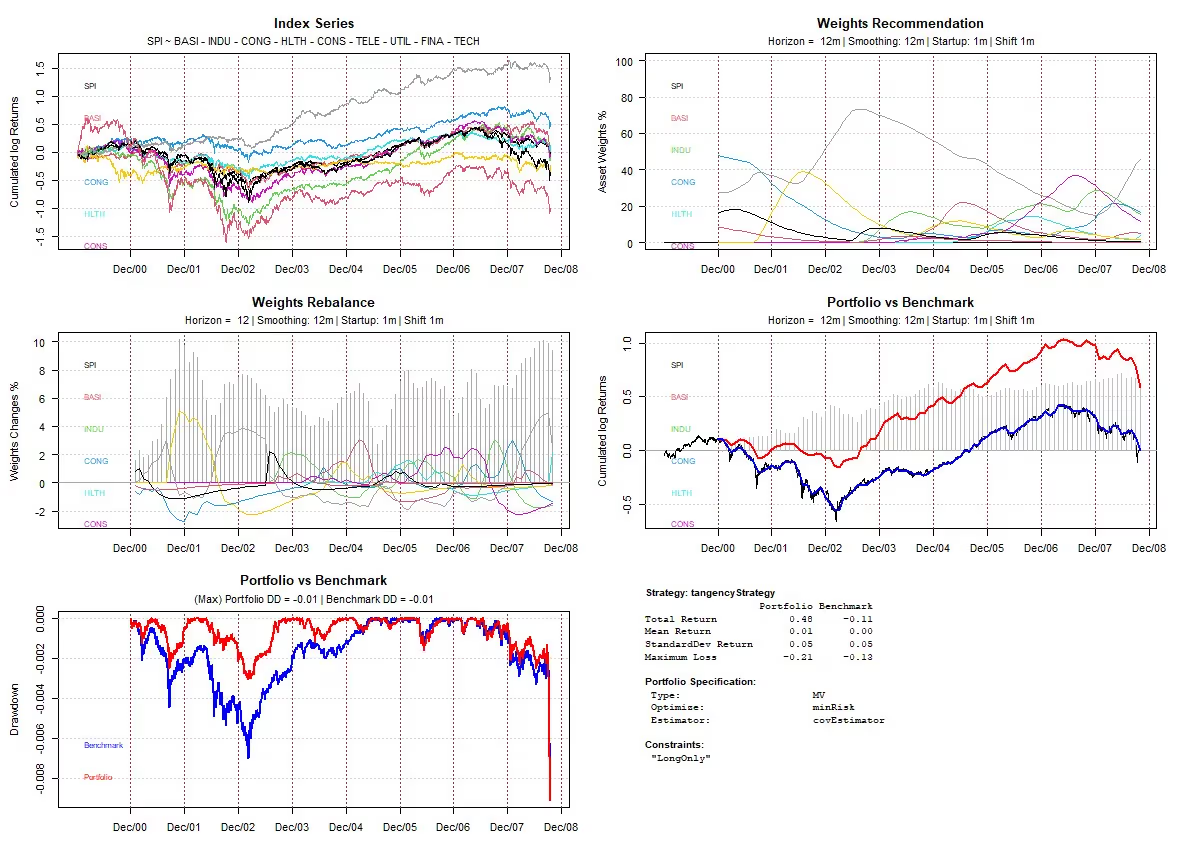

Plot backtests

1>backtestPlot(spiSmoothPortfolios, cex = 0.6, font = 1, family = "mono")

2

3#

4>netPerformance(spiSmoothPortfolios)

5

6Net Performance % to 2008-10-31:

7 1 mth 3 mths 6 mths 1 yr 3 yrs 5 yrs 3 yrs p.a. 5 yrs p.a.

8Portfolio -0.21 -0.25 -0.31 -0.44 -0.26 0.49 -0.09 0.10

9Benchmark -0.13 -0.17 -0.22 -0.38 -0.29 0.29 -0.10 0.06

10

11

12Net Performance % Calendar Year:

13 2001 2002 2003 2004 2005 2006 2007 YTD Total

14Portfolio -0.10 -0.09 0.25 0.25 0.22 0.29 0.05 -0.39 0.48

15Benchmark -0.25 -0.30 0.20 0.07 0.30 0.19 0.00 -0.32 -0.11

Output:

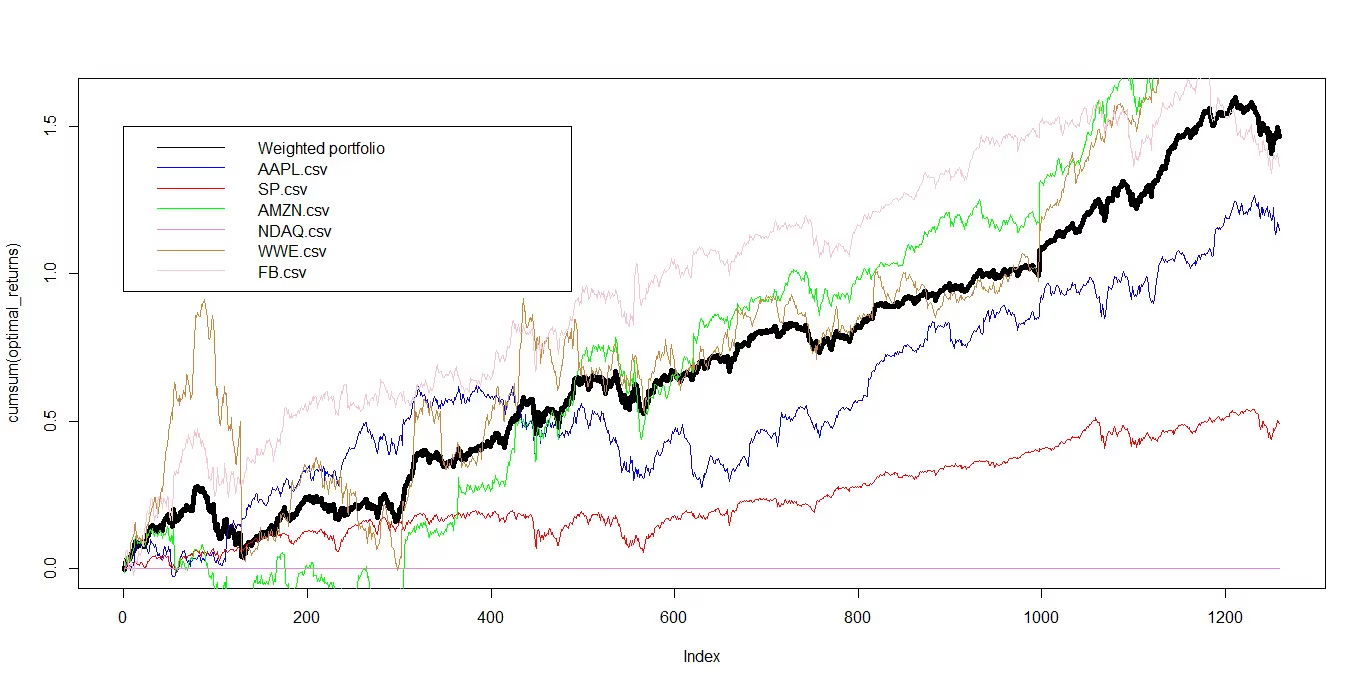

As shown in above graph if we had started the strategy in January 2001 the total portfolio return would have been 79.60%. During 2002 and 2003 when the market was on a downward trend the portfolio was able to absorb losses better than the benchmark. The amount of rebalancing see graph “Weights Rebalance” was also reasonable with a per month rebalancing of around 8%. Weights are smoothed with a double EMA smoother with a time decay of 6 months. The total return for the time frame tested is 48% for our portfolio vs -11% for the benchmark.

What to do next

If you made it through the end of this tutorial and you still don’t have enough we recommend you read the following books to gain a deeper understanding on the theoretical background of portfolio optimization.

Robust Portfolio Optimization and Management

Quantitative Equity Portfolio Management: Modern Techniques and Applications

Advances in Active Portfolio Management: New Developments in Quantitative Investing

————

References

Bacon, C. R. (2008). Practical Portfolio Performance Measurement and

Attribution (2 ed.). JohnWiley & Sons.

DeMiguel, V.; Garlappi, L.; and Uppal, R. (2009) . “Optimal versus Naive Diversification: How Inefficient Is the 1/N Portfolio Strategy?”. The Review of Financial Studies, pp. 1915—195.

DiethelmWürtz, Tobias Setz,William Chen, Yohan Chalabi, Andrew Ellis (2010). “Portfolio Optimization with R/Rmetrics”.

Guofu Zhou (2008) “On the Fundamental Law of Active Portfolio Management: What Happens If Our Estimates Are Wrong?” The Journal of Portfolio Management, pp. 26-33

Taleb N.N. (2019). The Statistical Consequences of Fat Tails (Technical Incerto Collection)

Würtz, D. & Chalabi, Y. (2009a). The fPortfolio Package. cran.r-project.org.

Wang, N. &Raftery, A. (2002). Nearest neighbor variance estimation (nnve):

Robust covariance estimation via nearest neighbor cleaning. Journal of

the American Statistical Association, 97, 994–1019.

Spread Trading Sector Index Futures – CME Group – CME Group https://www.cmegroup.com/education/articles-and-reports/spread-trading-sector-index-futures.html